Put Y Call Option

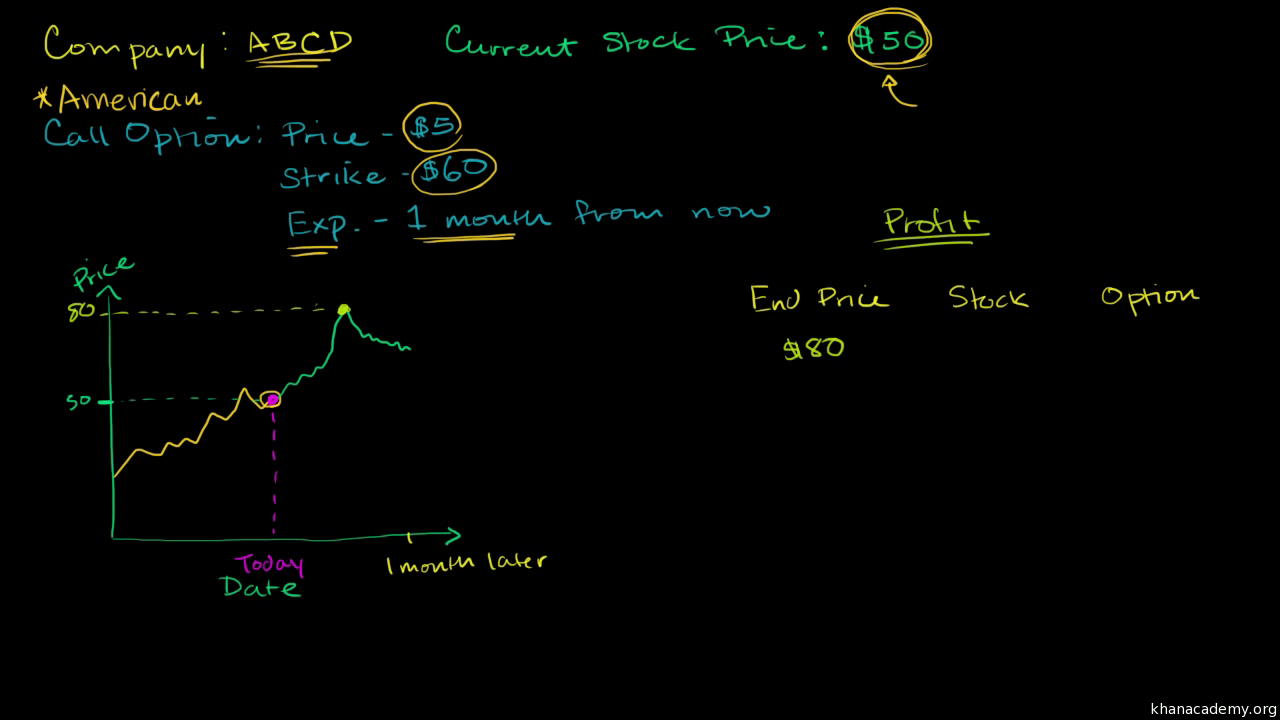

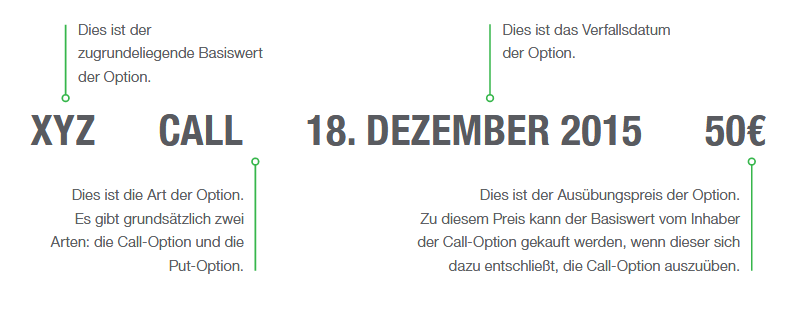

A call option, often simply labeled a "call", is a contract, between the buyer and the seller of the call option, to exchange a security at a set price The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument (the underlying) from the seller of the option at a certain time (the expiration date) for a.

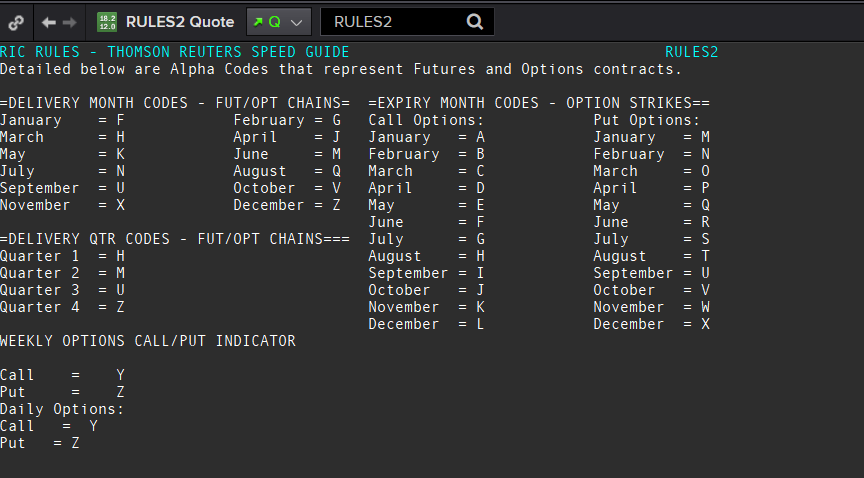

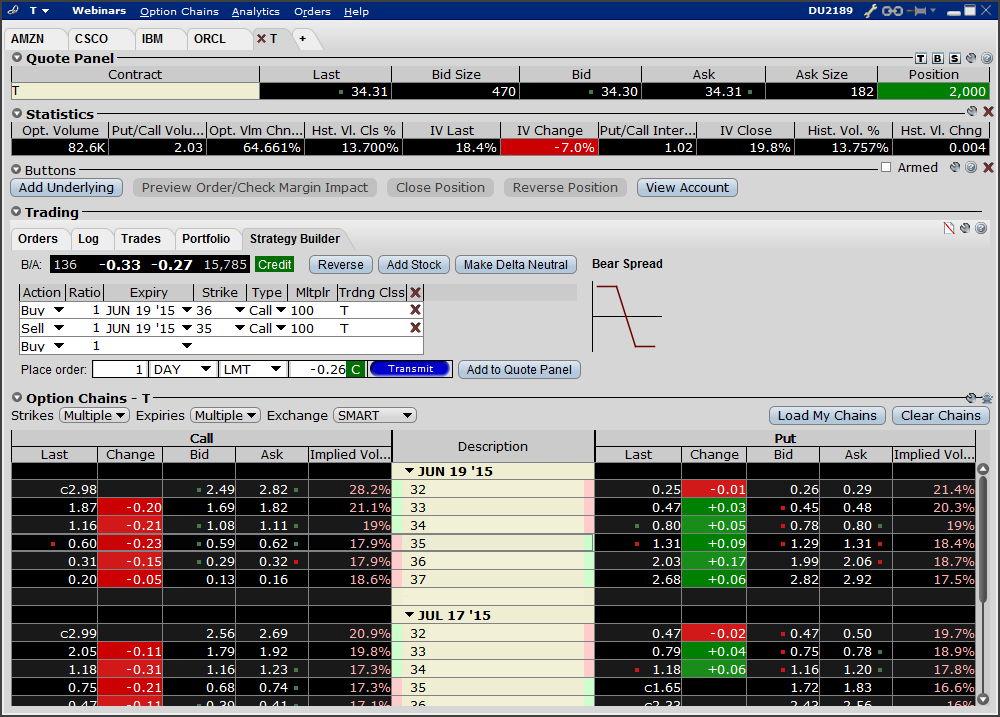

Put y call option. The put/call parity concept was introduced by economist Hans R Stoll in his Dec 1969 paper "The Relationship Between Put and Call Option Prices," published in The Journal of Finance. A call option provides you with profits similar to long stock, whereas a put option provides you with profits similar to short stock This makes sense given your rights as an option holder, which allow you to buy or sell stock at a set level. Option Symbol/Option Type Column 1 usually identifies the option what type, the company, or the security Here, you see the option symbol for a call option of MMC with a strike price of $50 expiring March 18, 16 Here is a breakdown of the symbol MMC MMC Stock symbol 16 03 18 Expiration date (YearMonthDay) C Type of option (C = call.

ในบทความนี้ เราจะพาไปทำความรู้จัก Call Option และ Put Option กันว่าคืออะไร ?. Call vs Put Option As previously stated, the difference between a call option and a put option is simple An investor who buys a call seeks to make a profit when the price of a stock increases. Call and put options are derivative investments, meaning their price movements are based on the price movements of another financial product The financial product a derivative is based on is often called the "underlying" Here we'll cover what these options mean and how traders and buyers use the terms What Are Call and Put Options?.

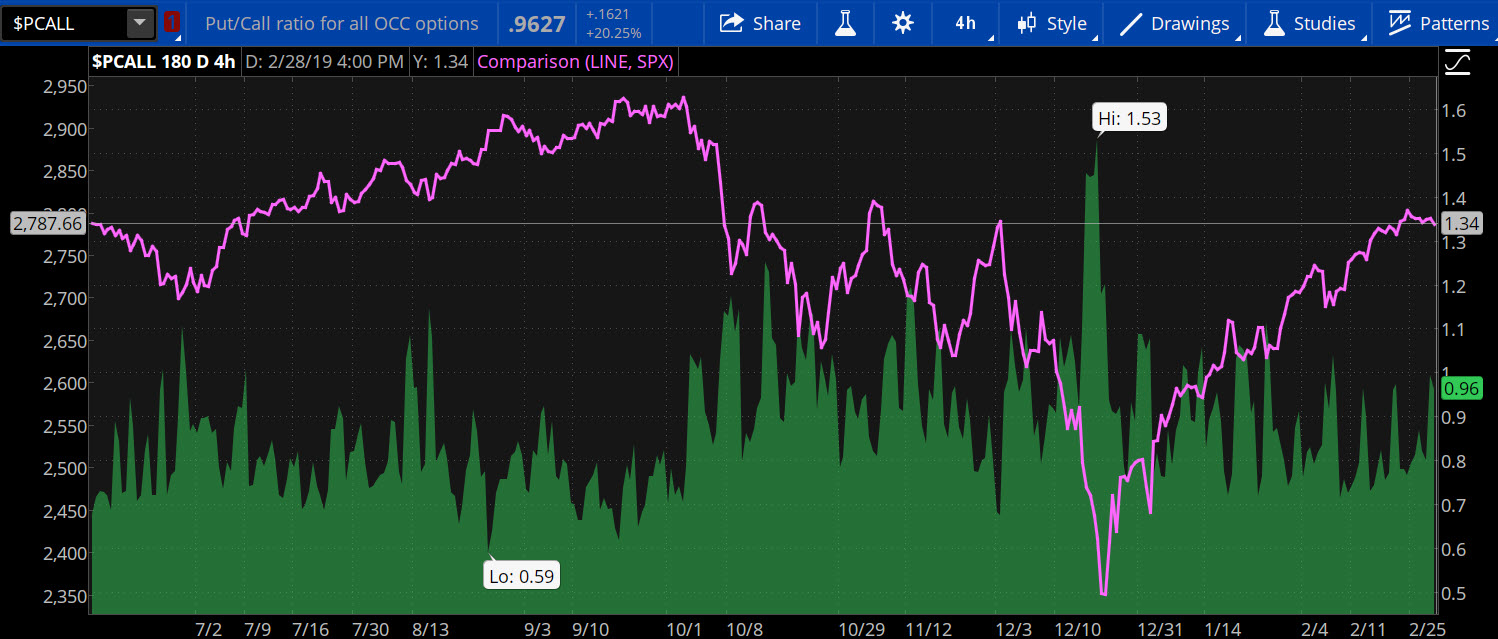

Please support us athttps//wwwpatreoncom/garguniversity In finance, an option is a contract which gives the owner the right, but not the obligation, to b. View TSLA's options chain, put prices and call prices at MarketBeat S&P 500 3, DOW 31, QQQ Top 3 Materials Stocks to Buy for 21 3 Stocks to Watch This Earnings Season Here’s Where Xpeng (NASDAQ XPEV) Stock Looks Attractive. The SPX Put/Call Ratio is an indicator that is used to gauge market sentiment This is calculated as the ratio between trading S&P 500 put options and S&P call options A high put/call ratio can indicate fear in the markets, while a low ratio indicates confidence For example, in 15, the PutCall.

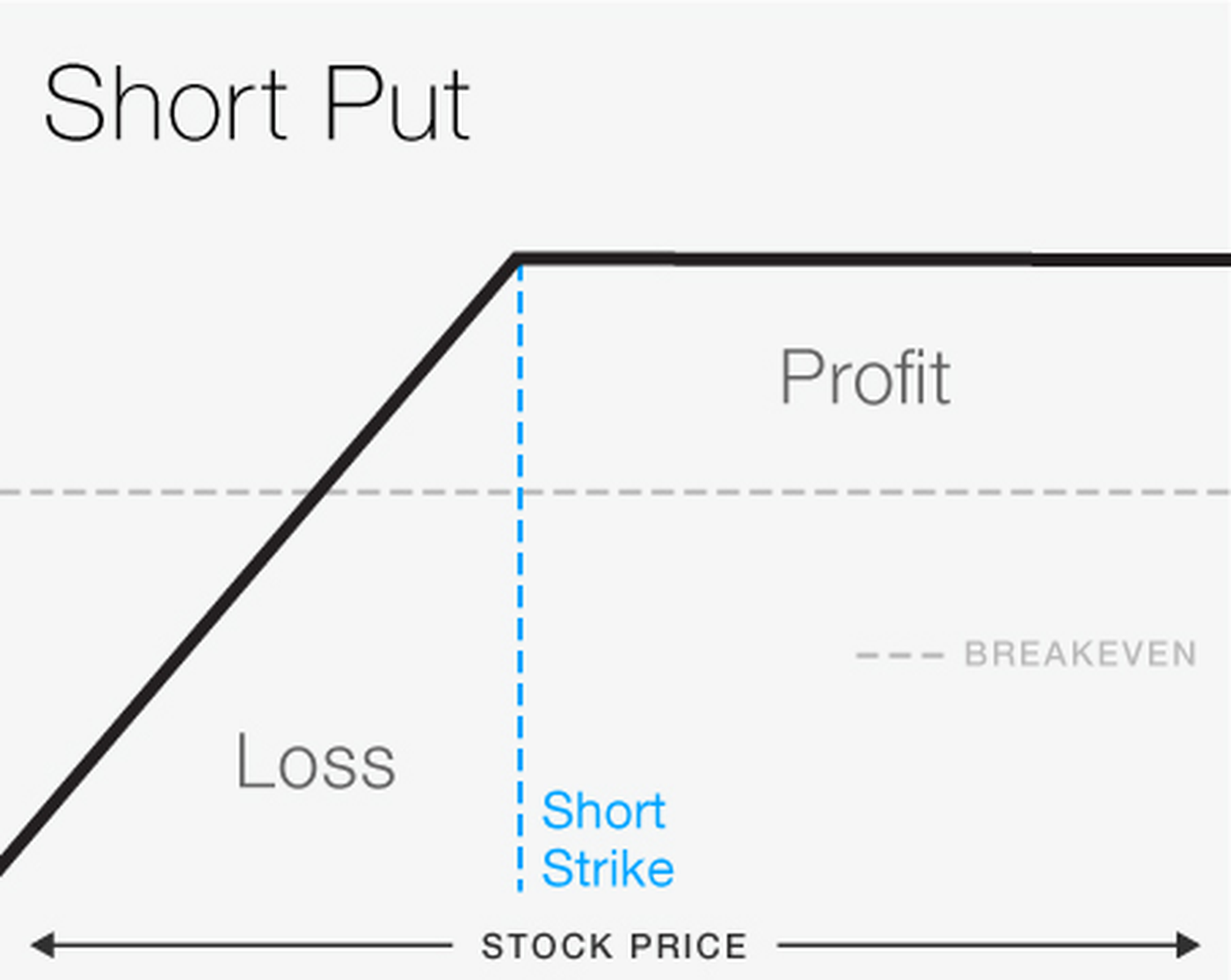

Long call position is created by buying a call option To initiate the trade, you must pay the option premium – in our example $0 Short put position is created by selling a put option For that you receive the option premium Long call has negative initial cash flow Short put has positive. View the basic QQQ option chain and compare options of Invesco QQQ Trust, Series 1 on Yahoo Finance. The putcall ratio for the security is 1,250 / 1,700 = How to Interpret the PutCall Ratio 1 Interpreting the Number A PCR below one (.

Cboe Volume & Put/Call Ratios Cboe Volume and Put/Call Ratio data is compiled for the convenience of site visitors and is furnished without responsibility for accuracy and is accepted by the site visitor on the condition that transmission or omissions shall not be made the basis for any claim, demand or cause for action. As the call and put options share similar characteristics, this trade is less risky than an outright purchase, though it also offers less of a reward These strategies are useful to pursue if you believe that the underlying price would move in a particular direction, and want to reduce your initial outlay if the prediction is incorrect. Turning to the calls side of the option chain, the call contract at the $ strike price has a current bid of $930 If an investor was to purchase shares of ARKG stock at the current price.

There are several components to the value of a call or put option trade An option's value is made up of its intrinsic value plus a time premium The current value of your option trade depends on. The call option just like a put option can be sold anytime up until expiration for a profit or loss When selling a call option, the option trader has the obligation to sell the underlying to the buyer at the strike price up until expiration if he or she desires to do so (called exercising their right). Please support us athttps//wwwpatreoncom/garguniversity http//wwwgarguniversitycom Check out Ebook "Mind Math" from Dr Garghttps//wwwamazoncom/MIN.

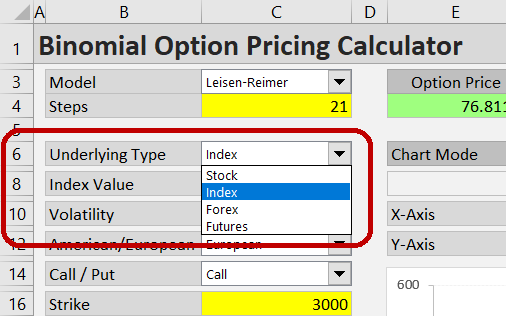

Exercise style of an option refers to the price at which and/or time as to when the option is exercisable by the holder. Presenting Option Analyzer app for smart option tradersCall option & Put option analysis can be done now with few clicks Greeks such as Delta, Gamma, Theta, Vega & value can be calculated using options calculator Option price movement & other option parameters can be tracked using the portfolio and watch feature Main features of the app 1. Opciones Call y Put 2 julio 15 1005 2 comentarios Las opciones financieras son productos que se encuadran dentro de la categoría de ‘derivados’ y que pese a ser desconocidas para el público en general se usan con mucha frecuencia en los mercados financieros, tanto para invertir como para cubrir posiciones , es decir, para controlar.

Turning to the calls side of the option chain, the call contract at the $ strike price has a current bid of $930 If an investor was to purchase shares of ARKG stock at the current price. Type of option means the classification of an option as either a ‘Put’ or a ‘Call’ What is exercise style?. PutCall Ratio The putcall ratio is an indicator ratio that provides information about the trading volume of put options to call options The putcall ratio has long been viewed as an indicator.

Differences Between Call and Put Options The terminologies of call and put are associated with the option contracts An option contract is a form of a contract or a provision which allows the option holder the right but not an obligation to execute a specific transaction with the counterparty (option issuer or option writer) as per the terms and conditions stated. View the basic GOOG option chain and compare options of Alphabet Inc on Yahoo Finance. Type of option means the classification of an option as either a ‘Put’ or a ‘Call’ What is exercise style?.

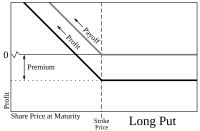

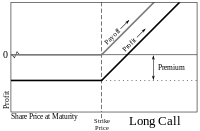

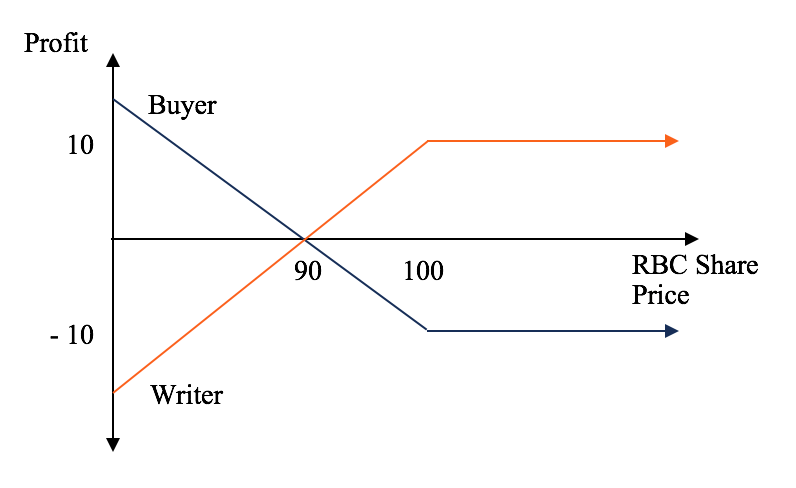

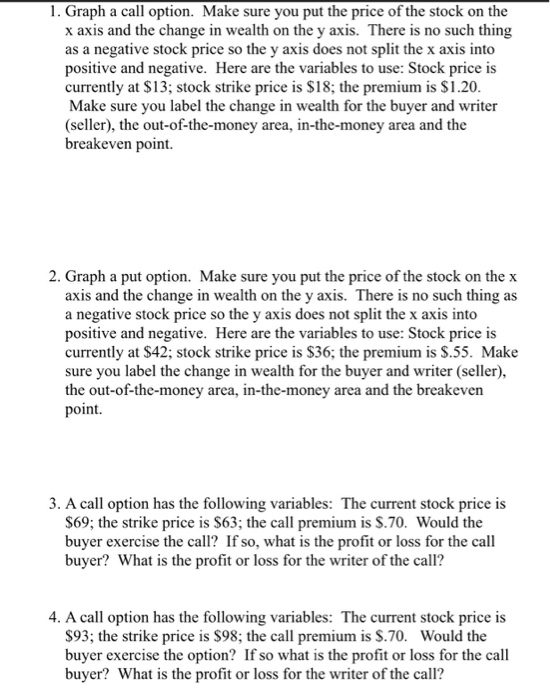

For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise. Unlike a call option, a put option is essentially a wager that the price of an underlying security (like a stock) will go down in a set amount of time, and so you are buying the option to sell. The call option just like a put option can be sold anytime up until expiration for a profit or loss When selling a call option, the option trader has the obligation to sell the underlying to the buyer at the strike price up until expiration if he or she desires to do so (called exercising their right).

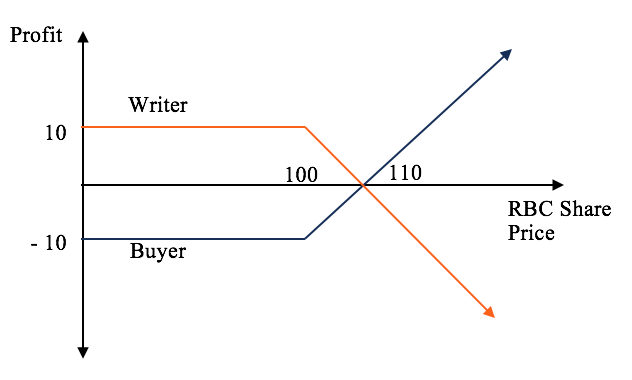

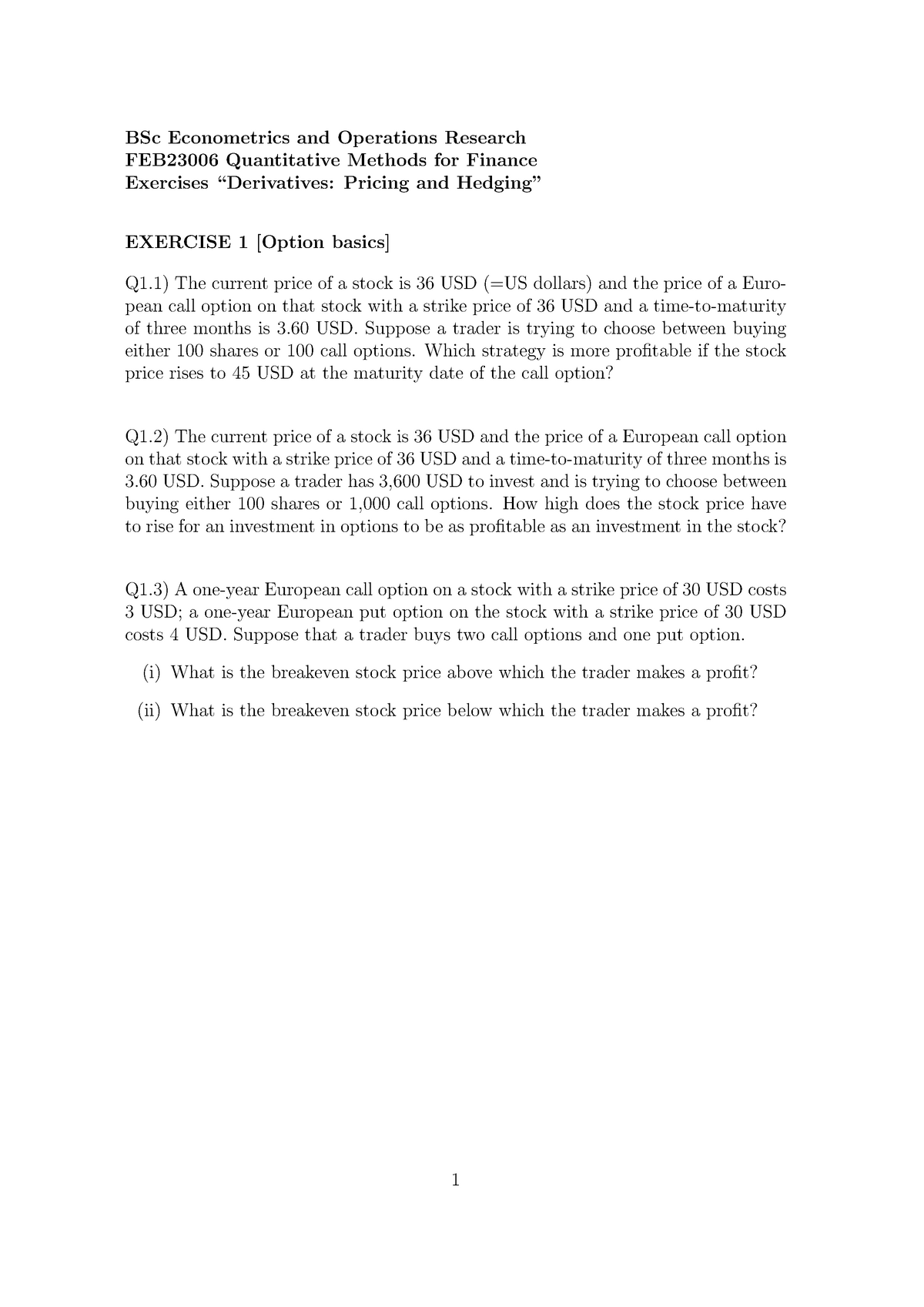

Suppose you were to buy a Call option at a strike price of $25, and the market price of the stock advances continuously, moving to $35 at the end of the option contract period. Call and Put Option Trading Tip When you buy a call option, you need to be able to calculate your breakeven point to see if you really want to make a trade If YHOO is at $27 a share and the October $30 call is at $025, then YHOO has to go to at least $3025 for you to breakeven. For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise.

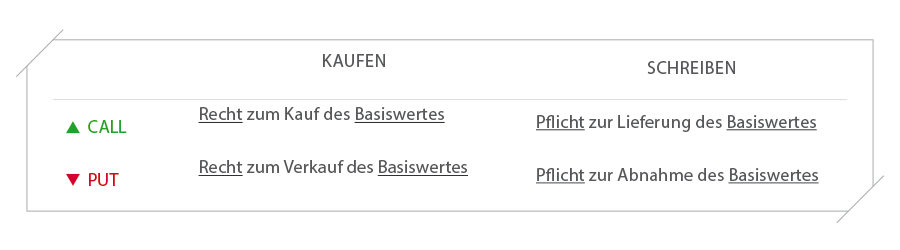

A call option allows buying option, whereas Put option allows selling option The call generates money when the value of the underlying asset goes up while Put makes money when the value of securities is falling The potential gain in case of a call option is unlimited, but such gain is limited in the put option In the call option, the. The third definition, in particular, is oftentimes a useful indicator to help determine which calls to buy You can use the option’s delta to determine what percentage of price risk you want to take versus buying the stock outright If you buy a 70 delta call, you have 70% of the price risk versus owning the stock outright. However put options and call options are often combined in one transaction, called a “put and call” option to achieve much the same effect as a conventional contract This is because if the buyer doesn’t exercise its call option, the seller can compel the buyer to proceed under the put option.

Exercise style of an option refers to the price at which and/or time as to when the option is exercisable by the holder. If the call option holder decides to exercise the right in the contract, the seller is obligated to sell the underlier at the strike price The opposite of a call option is the put options Put options give the options holder rights to sell an underlier at a strike price at a forward date Both call options and put options trade in the Indian. Enter an expected future stock price, and the Option Finder will suggest the best call or put option that maximises your profit Try Option Finder or read more about it Updates Compare an options trade vs the underlying stock purchase using the 'stock comparison' line in the Line Chart.

A call option provides the buyer of a call option with a hedge against rising prices Conversely, a put option provides the buyer of the put option with a hedge against declining prices As an example of how a fuel consumer (also referred to in the industry as an “enduser”) can utilize call options to hedge their exposure to fuel prices. พร้อมสิ่งที่เทรดเดอร์ Options Trading มือใหม่ต้องรู้. There are several components to the value of a call or put option trade An option's value is made up of its intrinsic value plus a time premium The current value of your option trade depends on.

View the basic SPY option chain and compare options of SPDR S&P 500 on Yahoo Finance. A call spread is an option strategy in which a call option is bought, and another less expensive call option is sold A put spread is an option strategy in which a put option is bought, and another less expensive put option is sold As the call and put options share similar characteristics, this trade is less risky than an outright purchase, though it also offers less of a reward. Puts and calls are short names for put options and call options When you own options, they give you the right to buy or sell an underlying instrument You buy the underlying at a certain price.

CBOE Equity Put/Call Ratio is at a current level of 037, N/A from the previous market day and down from 048 one year ago This is a change of N/A from the previous market day and 2292% from one year ago. Turning to the calls side of the option chain, the call contract at the $ strike price has a current bid of $930 If an investor was to purchase shares of ARKG stock at the current price. Call/Put options are the simplest ones and they are currently one of the best ways to begin your binary option trading career Call Option Let’s say that you’ve picked an asset that you want to trade and you’ve already read the data provided by the technical tools You’ve analyzed all the information and recent financial news and you.

There are only 2 types of options contracts Calls and Puts Everything in the options trading world revolves around the use of these 2 contract types In th. On the CALLS side of the options chain, the YieldBoost formula looks for the highest premiums a call seller can receive (expressed in terms of the extra yield against the current share price — the boost — delivered by the option premium), with strikes that are outofthemoney with low odds of the stock being called away. Ya lei tu instructivo y me suscribi, ahora te envio esto para que me orientes un poco mas La idea es iniciar con las opciones, obviamente aprender a utilizar primero el call (alcista)(oblig a venderlo al precio que yo estimo en el plazo que yo estimo) y despues el put (bajista) (no me obliga a venderloal vencimiento) "esto es lo que yo entendi.

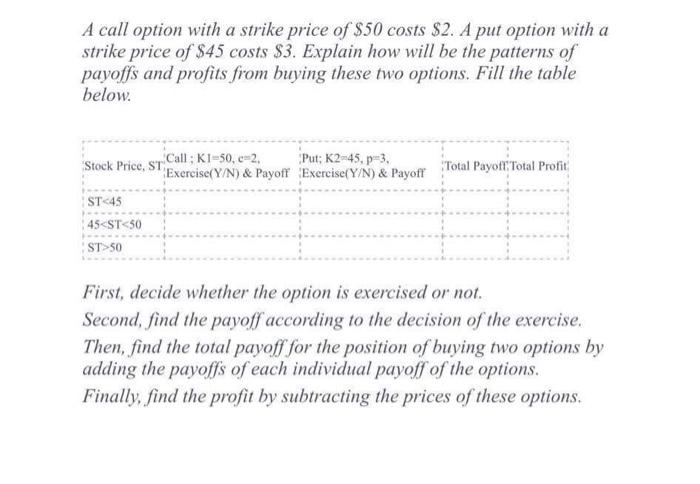

While opposite in their approach to taking advantage of market movements, a call option and a put option both offer the opportunity to diversify a portfolio and earn another stream of income News from the World's Most Trusted Financial Advisors. Turning to the calls side of the option chain, the call contract at the $5800 strike price has a current bid of $216 If an investor was to purchase shares of LVS stock at the current price. Put and call options explained When purchasing call option and put option contracts, you are given the right but not the obligation to purchase the option contract at a set price This is known as the strike price One options contract is the equivalent of 100 shares of the stock For example, if you are looking at a stock and the technical.

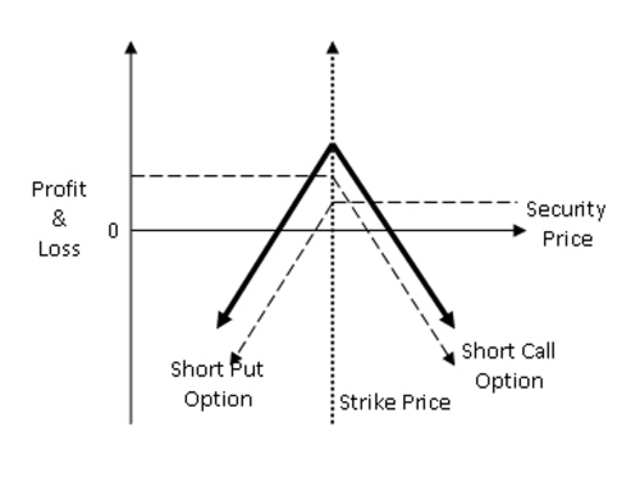

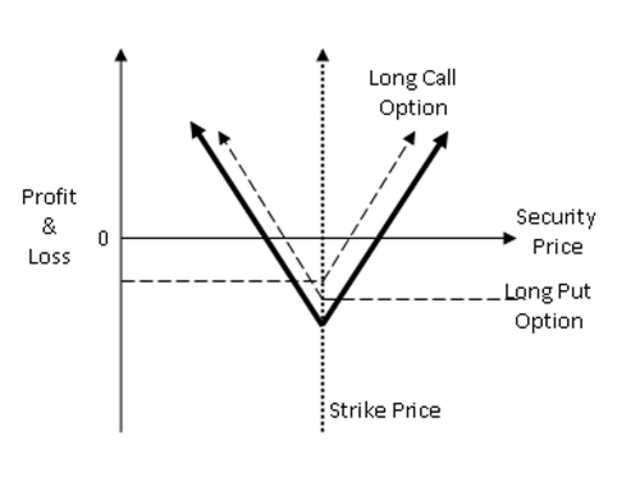

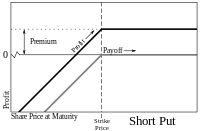

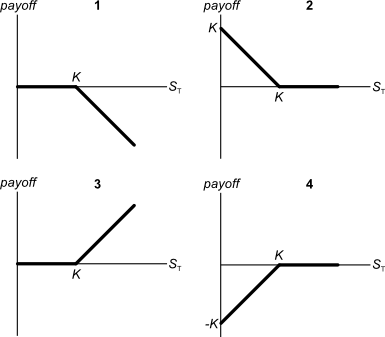

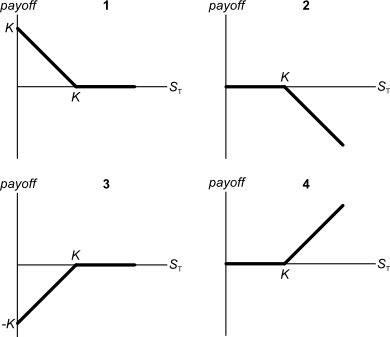

4 Basic Option Positions Recap Of the four basic option positions, long call and short put are bullish trades, while long put and short call are bearish trades It may sound confusing in the first moment, but when you think about it for a while and think about how the underlying stock’s price is related to your profit or loss, it becomes very logical and straightforward. The call option is clearly worthless You wouldn't exercise the call option if the stock is worth zero You would want to buy something for $50 that's worth 0 So from the stock's being worth zero, all the way up to the stock being worth $50, you would want to exercise the put option But the value of the put option is going to become lower and. Puts and calls are short names for put options and call options When you own options, they give you the right to buy or sell an underlying instrument You buy the underlying at a certain price.

A call option provides you with profits similar to long stock, whereas a put option provides you with profits similar to short stock This makes sense given your rights as an option holder, which allow you to buy or sell stock at a set level There is one slight difference between stock rewards and option rewards Options require an initial. The call and put options are the building blocks for everything that we can do as a trader in the options market There are only two types of options contracts, namely the call vs put option Let’s dig deeper A call option is when you bet that a stock price will be above a certain price on a certain date.

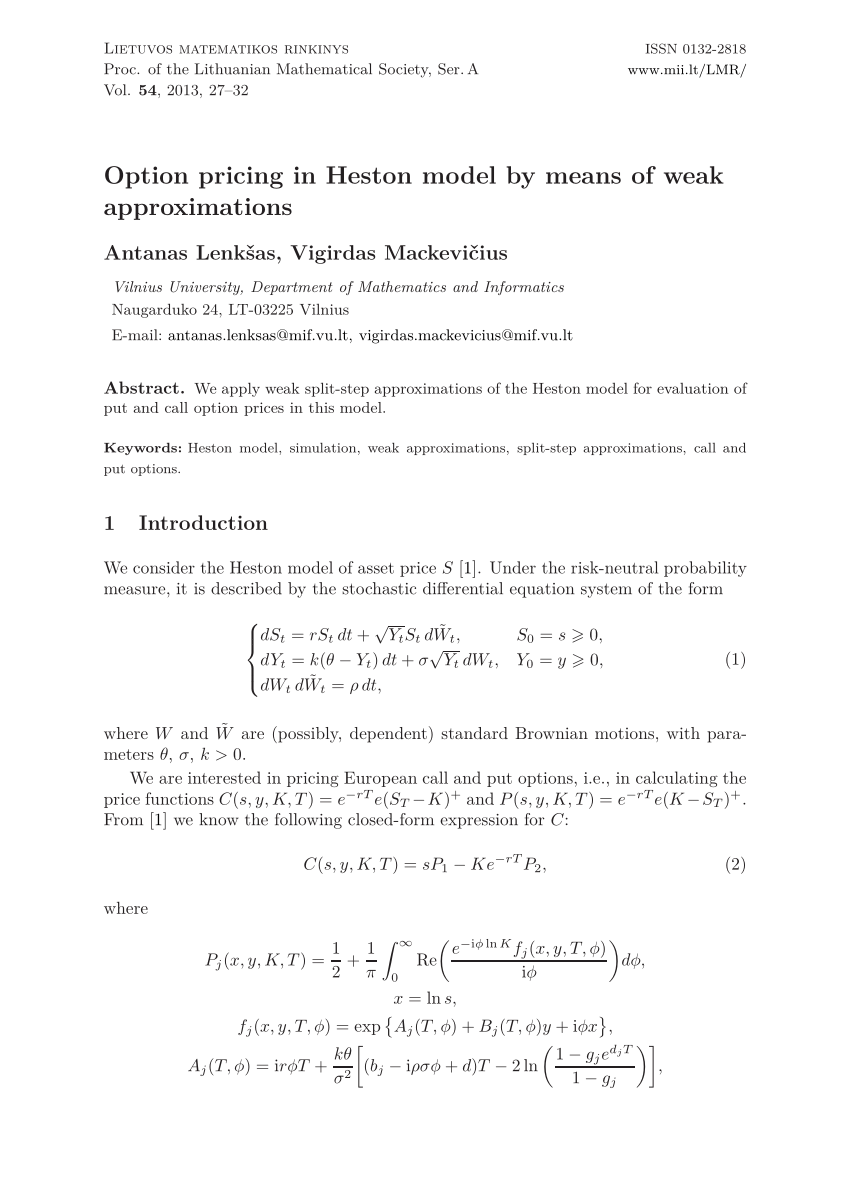

Option Pricing Model International Finance Lecture Slides Docsity

What Is Straddle Definition Of Straddle Straddle Meaning The Economic Times

Put Option Wikipedia

Put Y Call Option のギャラリー

Perdisco Put Call Options Bus2 Studocu

Topic11 12 Options Denitions Call Option A Security That Gives Its Owner The Right But Not The Obligation To Purchase A Specied Asset For A Specied Course Hero

Double Call Put Binary Options Iq Option Basic Iq Option Strategies In Options Trading Youtube

Call Option Wikipedia

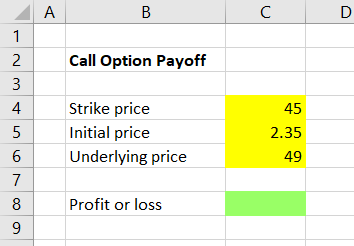

Calculating Call And Put Option Payoff In Excel Macroption

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

10 Options Strategies To Know

3

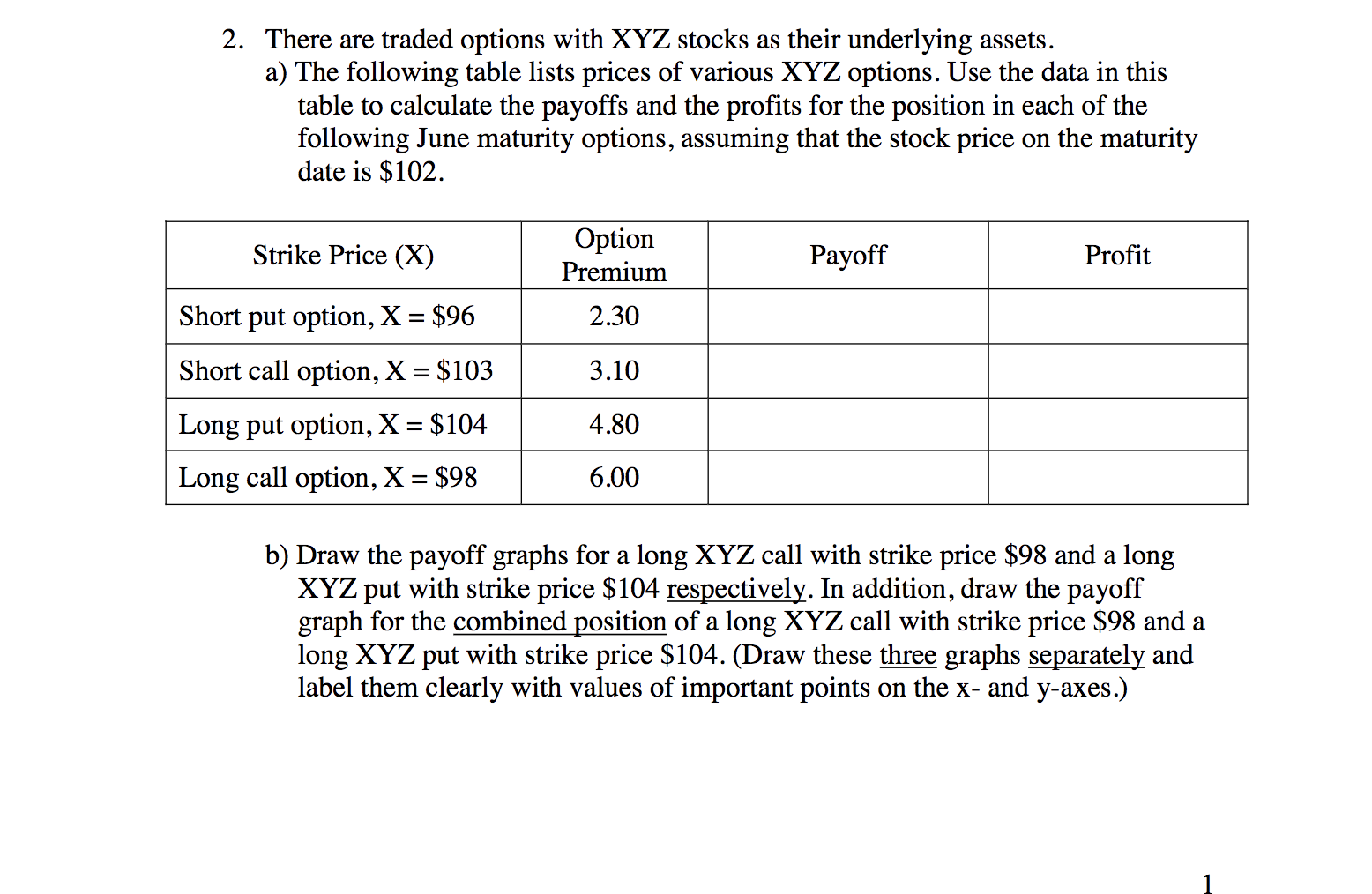

Solved 2 There Are Traded Options With Xyz Stocks As The Chegg Com

Put Option And Call Option Contracts By Put And Call Brokers And Dealers Association Inc Very Good Soft Cover 2nd Edition Alanpuri Trading

Opciones Binarias High Call Y Low Put Leccion 7

What Is Straddle Definition Of Straddle Straddle Meaning The Economic Times

Short Call Vs Long Call Explained The Options Bro

Calculating Call And Put Option Payoff In Excel Macroption

Put Option Wikipedia

Pdf Accelerating American Option Pricing In Lattices

Call And Put Synthetic Long Stock Option Trading Guide

Http Www Fightfinance Com

Chapter Understanding Options Pdf Free Download

European Put And Call Option Prices P S Y K T And C S Y K T Download Scientific Diagram

The Put Option Call Option Method Of Binary Options Trading The Put Option Call Option Method

Doi Org 10 5901 Mjss 17 V8n1p46

Options Calls And Puts Overview Examples Trading Long Short

Image Of Concept Buy And Sell Word Design Image For Stock Market Put And Call Option Ln Picxy

Options Futures And Other Derivatives Book Solutions Studocu

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Protective Put Definition

Call Option Explained Online Option Trading Guide

Options Trading Guide What Are Put Call Options Ticker Tape

Delta Hedging Simplify Your Option Pricing Refinitiv Developers

Find Historical Option Price For Given Ticker Date And Strike Price Closest Trading Price Forum Refinitiv Developer Community

3

Exercises Derivatives Pricing And Hedging Feb Eur Studocu

Puts Vs Calls In Options Trading What S The Difference Benzinga

Call Put Options Call Option Put Option Stock Option Financial Option Option Strategies Call Strategy Put Strategy Callputoptions Ygraph Com

Call Option Vs Put Option Difference And Comparison Diffen

Options Trading Guide What Are Put Call Options Ticker Tape

Using The Put Call Ratio To Gauge Stock Market Sentiment Ticker Tape

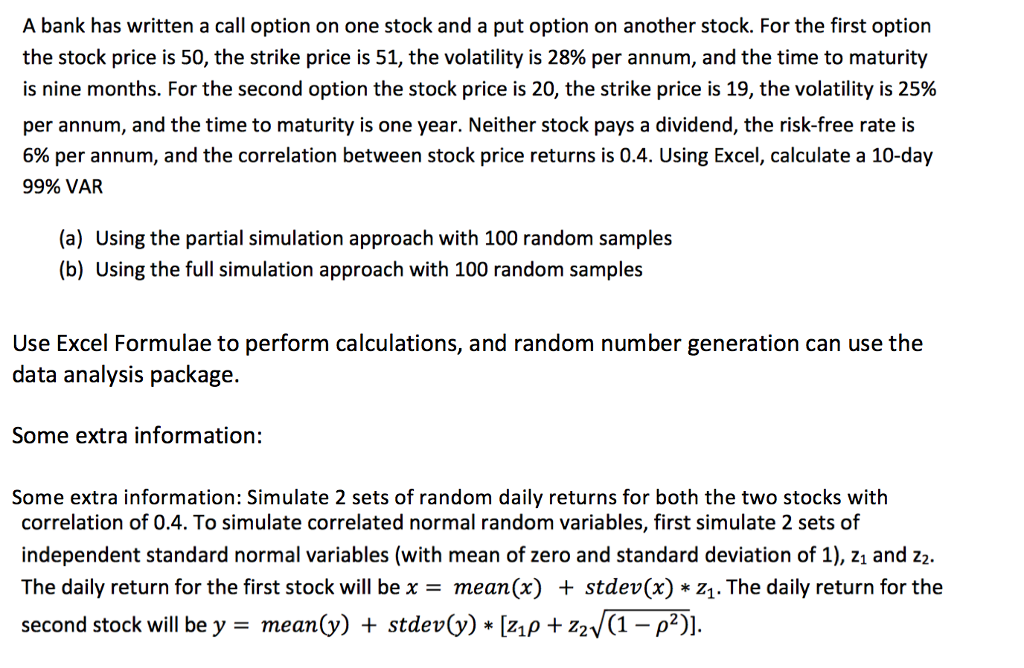

Solved A Bank Has Written A Call Option On One Stock And Chegg Com

Options Calls And Puts Overview Examples Trading Long Short

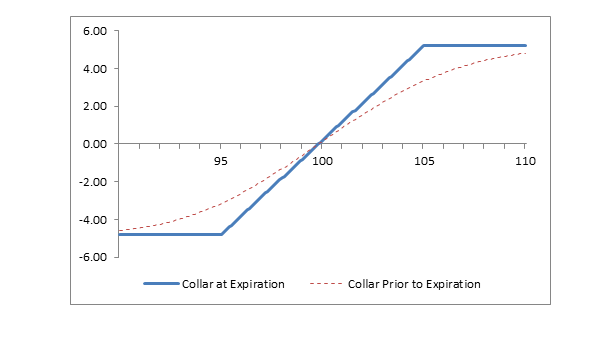

What Is A Collar Position Fidelity

Http Www Fightfinance Com

Call Options Intro American Finance Investing Video Khan Academy

Vinegarhill Financelabs Graphics

Puts Vs Calls In Options Trading What S The Difference Benzinga

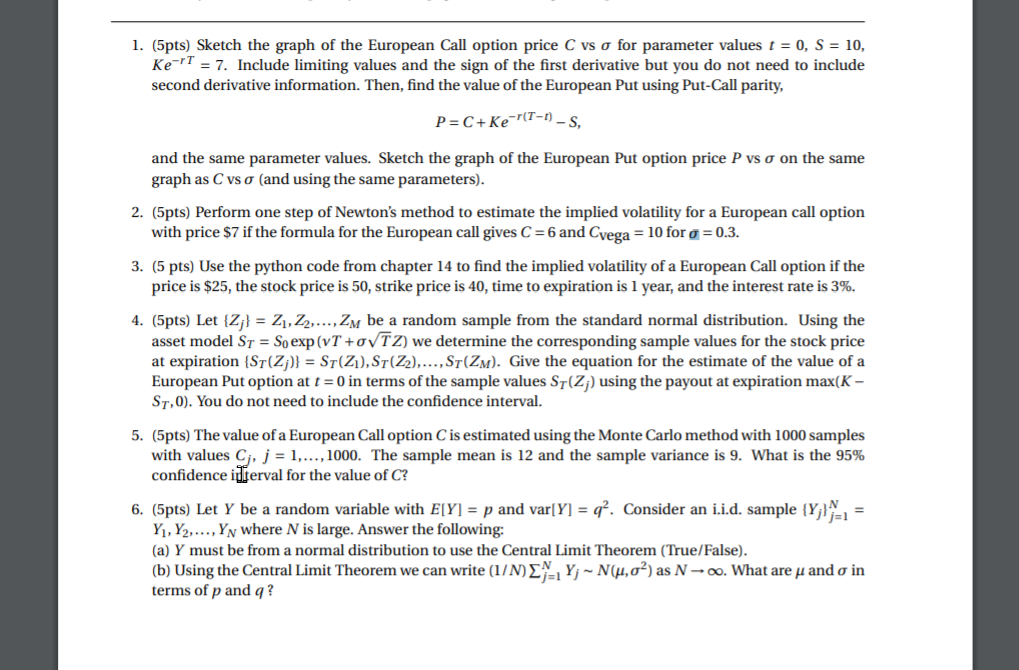

1 5pts Sketch The Graph Of The European Call Op Chegg Com

Intraday Strategy Call Put Trader Workstation Option Strategy Builder Proyectos Y Desarrollo Fjo

Long Call Option Long Call Strategy Firstrade Securities

:max_bytes(150000):strip_icc()/call-and-put-options-definitions-and-examples-1031124-FINAL-5bfd786646e0fb0026474cd7.png)

Call And Put Options What Are They

.png)

Descubre Las Diferencias Entre Las Opciones De Compra Call Y Venta Put

Call Option What Are Call Put Options The Economic Times

Call And Put Synthetic Long Stock Option Trading Guide

Covered Call Wikipedia

A Call Option With A Strike Price Of 50 Costs 2 Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Short Call Definition

Options Trading Guide What Are Put Call Options Ticker Tape

Warrants Vs Options Understanding The Key Differences Stock Investor

Call Put Option Trade Home Facebook

Adding Multiple Call Put Options Payoff Functions Options Futures Derivatives Commodity Trading

Call Option And Put Option Svtuition

What Is Put Call Ratio Definition Of Put Call Ratio Put Call Ratio Meaning The Economic Times

Options Calls And Puts Overview Examples Trading Long Short

Be In The Money Understanding Trading Strategies By Farhad Malik Fintechexplained Medium

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

Beginner S Guide To Call Buying

Call Vs Put Option Basic Options Trading Principles

:max_bytes(150000):strip_icc()/PutCallRatio-5c813e7946e0fb00019b8efa.png)

Put Call Ratio Definition

Options Cfd Trading Trade Options Plus500

Solved For At The Money European Call And Put Options On Chegg Com

Call Put Options Put Option Option Finance

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Call Option Definition

Adding Multiple Call Put Options Payoff Functions Options Futures Derivatives Commodity Trading

Short Call Vs Long Call Explained The Options Bro

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Understanding How Options Are Priced

European Put And Call Option Prices P S Y K T And C S Y K T Download Scientific Diagram

Currency Options An Option Is A Contract In Which The Buyer Of The Option Has The Right To Buy Or Sell A Specified Quantity Of An Asset At A Pre Specified Ppt

Call Options Vs Put Options Top 5 Differences You Must Know

Collar Option Strategy Collar Trade Strategy Firstrade

Basics Of Options Trading Explained

Solved 1 Graph A Call Option Make Sure You Put The Pric Chegg Com

What Is Option Trading 8 Things To Know Before You Trade Ally

Call Put Options Put Option Option Finance

European Put And Call Option Prices P S Y K T And C S Y K T Download Scientific Diagram

The Short Option A Primer On Selling Put And Call Op Ticker Tape

Solved Answer The Following Questions On Option Pricing Chegg Com

How To Sell Calls And Puts Fidelity

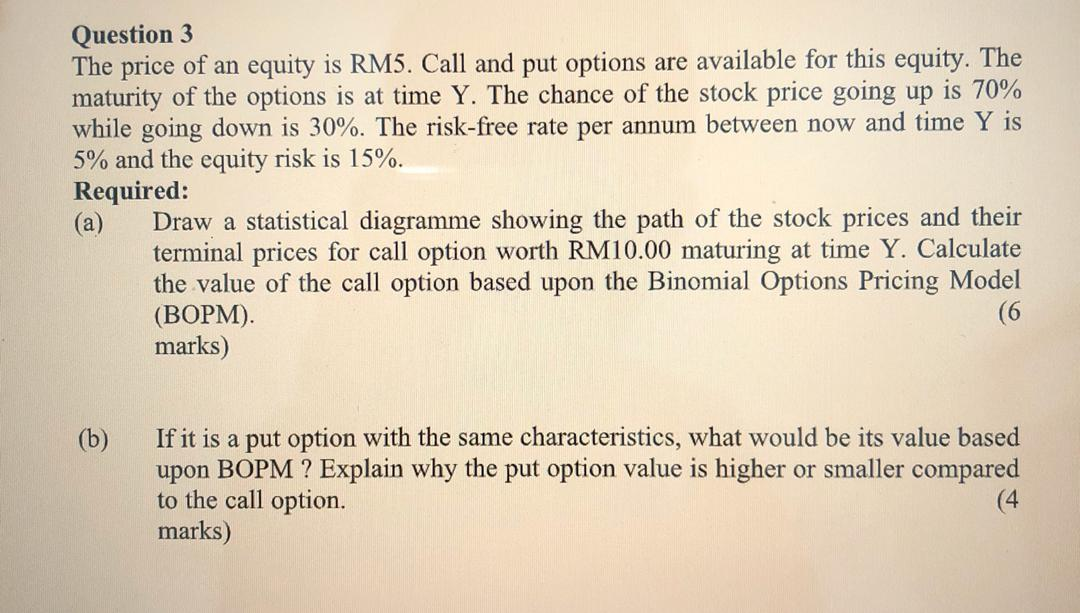

Solved Question 3 The Price Of An Equity Is Rm5 Call And Chegg Com

2

Image Of Concept Buy And Sell Word Design Image For Stock Market Put And Call Option Xb Picxy

In The Money Learn About In The Money Options Tastytrade Blog

Call Option Wikipedia

Optionen Grundlagen Und Begriffe Optionsgrundlagen Online Broker Lynx

Delta Hedging Simplify Your Option Pricing Refinitiv Developers

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

Put Option Definition

Covered Call Wikipedia

Atm At The Money Call Put Options Moneyness Of Options Options Futures Derivatives Commodity Trading

Optionen Grundlagen Und Begriffe Optionsgrundlagen Online Broker Lynx

1

Figure B2 D Left And G Right For The American Put Option Of Table Download Scientific Diagram

Short Call Vs Long Call Explained The Options Bro

Index Options Binomial Option Pricing Calculator Macroption

Call Options Intro American Finance Investing Video Khan Academy

What Are Options And What Is Options Trading Kotak Securities