Numero Vat

A valueadded tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale The amount of VAT that the user.

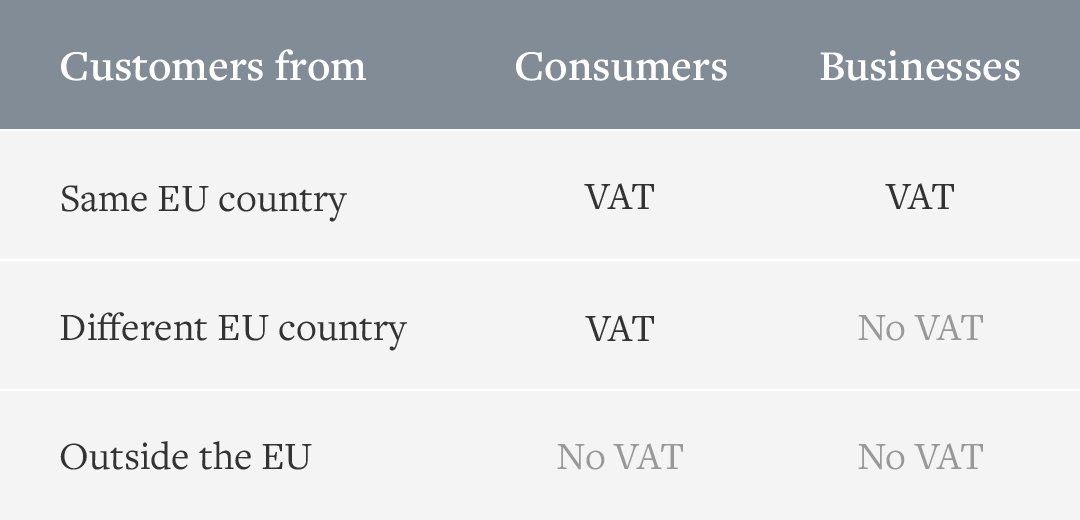

Numero vat. VAT and IIBB return periods Monthly Thresholds for registration VAT For corporations and other legal entities, commencement of activity For individuals, registration required if sales are the higher of the following ARS600,000 for goods ARS400,000 for services IIBB Commencement of sales activity Recovery of VAT or IIBB by non. Si consiglia di controllare ogni numero di partita IVA a parte Se l'autorità, che si occupa di IVA, scoprirà che, per errore, Voi non avete indicato il numero di partita IVA su una certa fattura, Vi può essere intestata una multa La struttura di partite IVA in vari paesi membri di UE è diversa. 39 If the delivery is deemed to be an intracommunity transaction subject to 0% VAT (within the meaning of article 28, quater subsection A of EEC Directive 91/680 of the European Council), the buyer if the buyer arranges the transport must inform the vendor in writing and in.

El VAT es un número de identificación para una empresa que desee realizar operaciones a nivel europeo Es importante diferenciarlo del NIF Ambos sirven para identificar a una corporación, pero en ámbitos bien distintos. VAT and IIBB return periods Monthly Thresholds for registration VAT For corporations and other legal entities, commencement of activity For individuals, registration required if sales are the higher of the following ARS600,000 for goods ARS400,000 for services IIBB Commencement of sales activity Recovery of VAT or IIBB by non. All traders seeking to validate UK (GB) VAT numbers may address their request to the UK Tax Administration Puede verificar la validez de un número de IVA en un país / Irlanda del Norte dado seleccionando en el menú desplegable el Estado Miembro / Irlanda del Norte e indicando luego el número de IVA que quiere comprobar.

Travellers' systemVAT refund and exemption;. Liittyykö alvnumeroon tietty liikkeenharjoittajan nimi ja osoite EUmaiden kansallisiin viranomaisiin fr de en saa yhteyden eri tavoin Joissakin maissa, kuten Saksassa, Italiassa ja Espanjassa, on verkkopalveluja, kun taas toisissa kyselyt hoidetaan puhelimitse, sähköpostitse tai faksilla. Remote sales Intracommunity Operations VIES.

VAT and IIBB return periods Monthly Thresholds for registration VAT For corporations and other legal entities, commencement of activity For individuals, registration required if sales are the higher of the following ARS600,000 for goods ARS400,000 for services IIBB Commencement of sales activity Recovery of VAT or IIBB by non. Each EU member country has a slightly different format for their VAT number system, featuring a variation of numbers and letters It is important that companies take close care in using the correct format as the numbers are frequently checked against the VIES system, and errors may create delays or even fines. Your members’ transactions (Skype Credit usage for calls, SMS or WiFi as well as purchases made with allocated Skype Credit) will incur VAT or GST if the registered billing address of the personal linked account is in a country where VAT or GST is applicable Monthly VAT invoices for members’ transactions are available in certain countries.

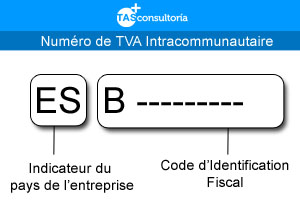

European VAT number (Número IVA) This is ‘ES’ followed by the CIF Social Security Number Your employer applies for this number when you start your first job in Spain This number then stays with you for all subsequent jobs If you are selfemployed, you apply yourself for this number CCC Number (código de cuenta de cotización). A VAT number has between 4 and 15 digits, starting with the twodigit country code (eg DE for Germany or IN for India), followed by 213 other characters. Value added tax (VAT) is imposed on any transaction executed in Israel, on import of goods and on provision of services, in a single rate from the sum of the transaction or the price of the goods, as prescribed in a decree issued by the Minister of Finance.

Obtener un número de IVA significa obtener un número de identificación fiscal en un país extranjero para llevar a cabo actividades comerciales sujetas a IVA 29 junio, Blog, Declaraciones de IVA IVA en las Operaciones Intracomunitarias qué es y cómo funciona. VATSearch has more than 600 clients including By using VATSearcheu you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries Read More Hide Contact Imprint GTC About VATSearcheu Language. Para conseguir el número de VAT intracomunitario, (no olvidemos que el NIF no es lo mismo que el VAT) debes dirigirte a la Delegación a la que corresponde tu empresa, e iniciar la solicitud, por otro lado, la Administración, dependiendo de la Delegación, pedirá o no unos requisitos para conceder dicho número VAT, por ello, te aconsejamos.

Value Added Tax (VAT) Topics How to pay tax and duty on personal goods purchased abroad You have to pay Swiss VAT on purchases made abroad after a certain sum or amount Claiming back VAT paid abroad You have to pay VAT at the local rate in the country in which you make purchases In certain cases you can claim back the VAT. Whilst France follows the EU rules on VAT compliance, it is still free to set its own standard (upper) VAT rate The only proviso is that it is above 15% Suppliers of goods or services VAT registered in France must charge the appropriate VAT rate, and collect the tax for onward payment to the French tax authorities through a VAT filling see French VAT returns briefing. VAT refund to nonestablished people (VAT Refund) VAT Telecommunications, Broadcast, TV and electronic services (OneStop Shop) Exemptions and refunds within the framework of diplomatic and consular relations, international organisations and NATO;.

For foreign businesses trading in Croatia that are VAT/GST/Tax registered in their home state, the VAT registration threshold is nil For EU VATregistered companies selling goods over the internet to consumers in Croatia (distance selling), the VAT registration threshold is HRK 270,000 which is approximately EUR36,000 per annum. Gibraltar is a country with a mixed background, a peninsula in the Southern part of Europe, very close to Africa Member of the European Union, Gibraltar is a territory that belongs to the United Kingdom, but in terms of taxation, it does not subdue to UK’s taxation lawsIf you are an investor interested in opening a company in Gibraltar, you should know that that the business environment. Si consiglia di controllare ogni numero di partita IVA a parte Se l'autorità, che si occupa di IVA, scoprirà che, per errore, Voi non avete indicato il numero di partita IVA su una certa fattura, Vi può essere intestata una multa La struttura di partite IVA in vari paesi membri di UE è diversa.

These VAT numbers are starting with the “XI” prefix, which may be found in the “Member State / Northern Ireland” drop down under the new entry “XINorthern Ireland” Moreover, any quote of “Member State” is replaced by “Member State / Northern Ireland” and any quote of “MS” is replaced by “MS / XI”. Non VAT registered companies can apply using this link – FORM C2 VAT registered companies can apply using this link – FORM C2A. Gibraltar is a country with a mixed background, a peninsula in the Southern part of Europe, very close to Africa Member of the European Union, Gibraltar is a territory that belongs to the United Kingdom, but in terms of taxation, it does not subdue to UK’s taxation lawsIf you are an investor interested in opening a company in Gibraltar, you should know that that the business environment.

VAT return periods Monthly or quarterly Annual returns No EC Sales Lists frequency Monthly or quarterly EC purchase lists Yes Other reporting requirements No Extended reverse charge Services and goods provided by a nonestablished to a VAT registered customer in Poland are subject to the reverse charge and the customer accounts for. A VAT number is exclusively for the ValueAdded Tax scheme What does a VAT number look like?. En este video explico qué es el número VAT que exigen en la mayoría de las páginas chinas Les dejo mi página en facebook, allí estaré subiendo más informaci.

For foreign businesses trading in France that are VAT/GST/Tax registered in their home state, the VAT registration threshold is nil For EU VATregistered companies selling goods over the internet to consumers in France (distance selling), the VAT registration threshold is €35,000 per annum since January 16. Ecommerce sales of goods to consumers, subject to Distance Selling VAT registration thresholds Organising events in Italy where attendees or delegates must pay admission If you are currently, or plan to conduct any of the above (or similar) transactions in Italy, you should contact us immediately for a complimentary consultation. European VAT number (Número IVA) This is ‘ES’ followed by the CIF Social Security Number Your employer applies for this number when you start your first job in Spain This number then stays with you for all subsequent jobs If you are selfemployed, you apply yourself for this number CCC Number (código de cuenta de cotización).

These VAT numbers are starting with the “XI” prefix, which may be found in the “Member State / Northern Ireland” drop down under the new entry “XINorthern Ireland” Moreover, any quote of “Member State” is replaced by “Member State / Northern Ireland” and any quote of “MS” is replaced by “MS / XI”. VAT refund to nonestablished people (VAT Refund) VAT Telecommunications, Broadcast, TV and electronic services (OneStop Shop) Exemptions and refunds within the framework of diplomatic and consular relations, international organisations and NATO;. El número VAT es un número de identificación que habilita a las empresas a operar en Europa Si necesitas facturar a otros países miembros estás obligado a solicitarlo y dado de alta en el mismo y supone una reducción en la carga fiscal para ambas partes.

Travellers' systemVAT refund and exemption;. A valueadded tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale The amount of VAT that the user. VATSearch has more than 600 clients including By using VATSearcheu you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries Read More Hide Contact Imprint GTC About VATSearcheu Language.

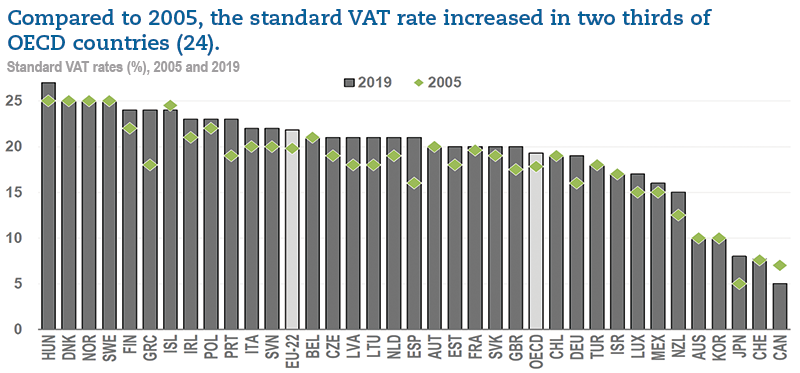

Value Added Tax (VAT Rates) per Country Including VAT (Value Added Tax) rates for Spain, France, Belgium, South Korea, Japan, Pakistan, Singapore and more. VAT registered companies will see the EORI as an extension of their VAT number Your VAT nine digit VAT number will be prefixed with “GB” and suffixed with “000” How do I apply for an EORI Number?. It is a tax on all purchases made by consumers anywhere within the EU The amount of tax may vary from EU member state to EU member state and may even vary within the same state on different products and services For example in Cyprus 19% is the standard VAT rate and 9% is the reduced rate on such things as restaurant.

NIT (Número de Identificación Tributaria) Honduras RTN (Registro Tributario Nacional) Unión Europa VAT (Value Added Tax) o NIF Código de Identificación Fiscal para empresas España CIF (Código de Identificación Fiscal). Value added tax (VAT) is imposed on any transaction executed in Israel, on import of goods and on provision of services, in a single rate from the sum of the transaction or the price of the goods, as prescribed in a decree issued by the Minister of Finance. VAT return periods Monthly or quarterly Annual returns No EC Sales Lists frequency Monthly or quarterly EC purchase lists Yes Other reporting requirements No Extended reverse charge Services and goods provided by a nonestablished to a VAT registered customer in Poland are subject to the reverse charge and the customer accounts for.

VAT stands for valueadded tax It's a tax based on the consumption of goods and services that is commonly found in the EU and select other regions of the world VAT is also known as JCT, GST, SST, or QST in some countries. The EU VAT number must be used for all intraCommunity movements It is made up of the acronym for France " FR " followed by two digits to double check the logarithm and the 9 digits of your SIREN number. Whilst France follows the EU rules on VAT compliance, it is still free to set its own standard (upper) VAT rate The only proviso is that it is above 15% Suppliers of goods or services VAT registered in France must charge the appropriate VAT rate, and collect the tax for onward payment to the French tax authorities through a VAT filling see French VAT returns briefing.

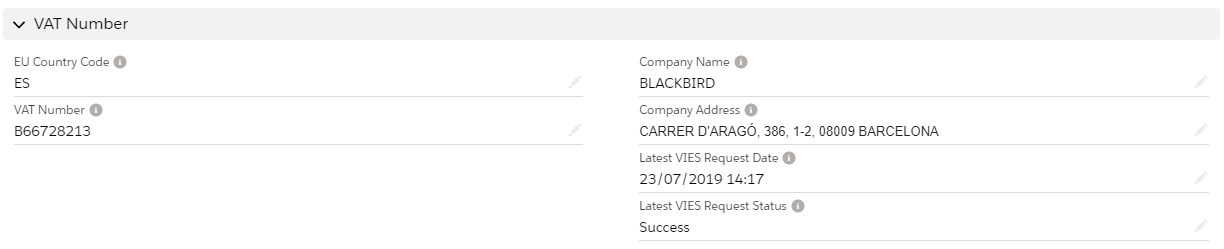

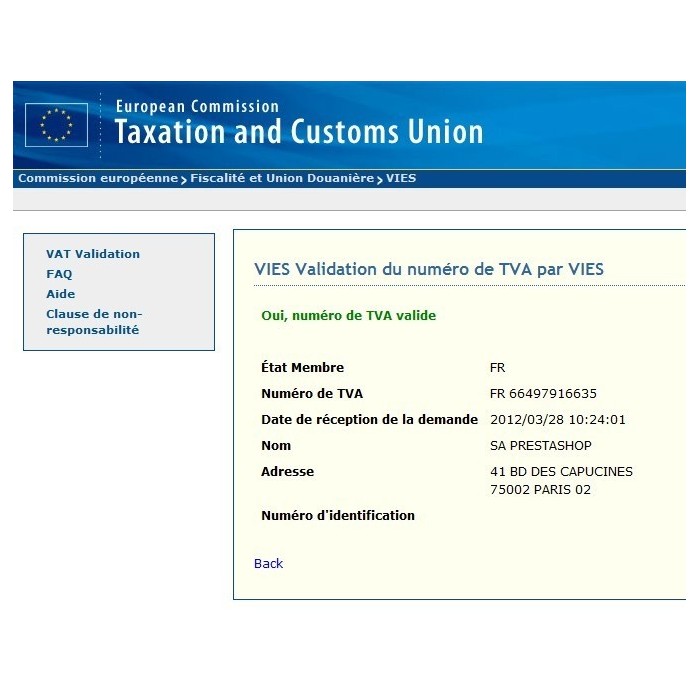

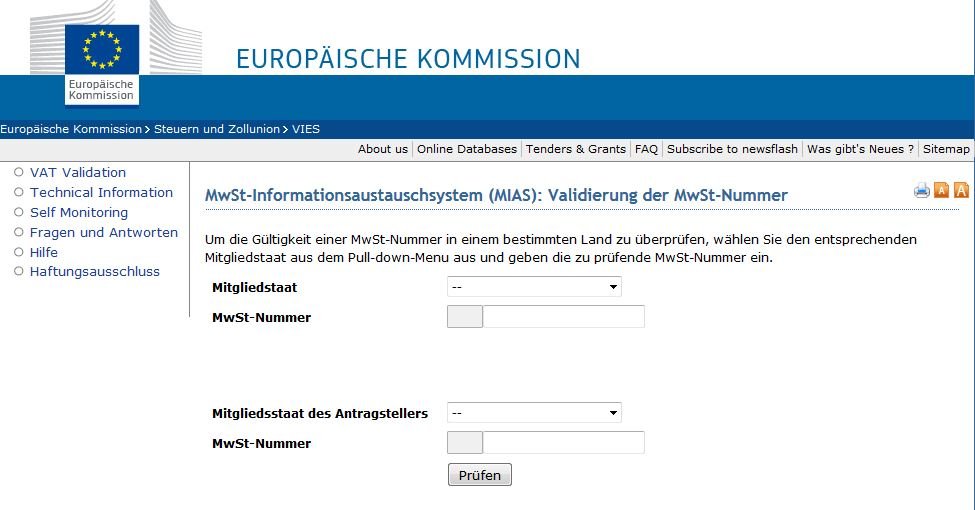

VERIFICATION OF AN INTRACOMMUNITY VAT NUMBER USING THE VIES DATABASE The tax identification number (intracommunity VAT number) of companies in the member States of the European Union are collected in a computer database which can be consulted at the official EU website, EuropaThe validity of the VAT numbers of clients and suppliers can be verified on this database. Un número de identificación del contribuyente (TIN, por sus siglas en inglés) es un número de identificación utilizado por el Servicio de Impuestos Internos (IRS) en la administración de las leyes tributarias Lo emite la Administración del Seguro Social (SSA) o el IRS El número de Seguro Social (SSN) lo emite la SSA, mientras todos los otros TIN los emite el IRS. Para conseguir el número de VAT intracomunitario, (no olvidemos que el NIF no es lo mismo que el VAT) debes dirigirte a la Delegación a la que corresponde tu empresa, e iniciar la solicitud, por otro lado, la Administración, dependiendo de la Delegación, pedirá o no unos requisitos para conceder dicho número VAT, por ello, te aconsejamos.

VAT deregistration in the Netherlands is closely linked to the company’s registration status with the Chamber of Commerce (KVK) When the company is deregistered from the Chamber, it will also be deregistered from the Tax and Customs Administration This is an automatic process that will lead to the termination of the VAT number. Value Added Tax ("VAT") HB 2329 proposes the implementation of a VAT to substitute the current sales and use tax regime The VAT is a consumption oriented tax that is placed on a product whenever value is added through the distribution chain and at the final sale. Vérifiez les informations d'une entreprise SIRET, SIREN,TVA intracommunautaire,tva intracommunautaire gratuite,numero intracommunautaire,tva intra,nom du dirigeant sur la France entière.

The current VAT number validation format is CH 6 digits (the six digits after the prefix should be numeric) Example CH Swiss companies can continue to use the current VAT number format until the end of 13 New Behavior Effective from January 14, there are changes in the validation of Tax Registration Number. Bulgarian VAT law Bulgarian VAT law is contained within the Value Added Tax Law 07 It is administered by the Bulgarian Ministry of Finance and the National Revenue Agency Bulgarian VAT Registration Foreign companies may register for VAT in Bulgaria without the need to form a local company, which is known as nonresident VAT trading. VAT Rates VAT Number Format Distance Selling Threshold Intrastat Threshold 21% (Standard) NLB01 € 100,000 € 800,000 (Arrivals) 9% (Reduced).

VAT is value added tax;. VAT stands for valueadded tax It's a tax based on the consumption of goods and services that is commonly found in the EU and select other regions of the world VAT is also known as JCT, GST, SST, or QST in some countries. Remote sales Intracommunity Operations VIES.

Número VAT qué es y cómo se tramita Holded junio 25, junio 26, 18 En el presente texto trataremos de explicar qué es el VAT y cómo puedes tramitarlo. Tarkista aina uuden kauppakumppanin arvonlisäverotunnisteen (VATnumber) voimassaolo, ennen kuin käytät sitä EUkaupan laskutuksessa Saat numeron kauppakumppaniltasi Muista myös tarkistaa säännöllisesti vanhojen kauppakumppaneittesi arvonlisäverotunnisteen voimassaolo. VAT deregistration in the Netherlands is closely linked to the company’s registration status with the Chamber of Commerce (KVK) When the company is deregistered from the Chamber, it will also be deregistered from the Tax and Customs Administration This is an automatic process that will lead to the termination of the VAT number.

Understanding VAT VAT is, in essence, a countrylevel sales tax that applies to most goods and services The tax can be applied at the standard rate, which, to use the European Union as an. Ecommerce sales of goods to consumers, subject to Distance Selling VAT registration thresholds Organising events in Italy where attendees or delegates must pay admission If you are currently, or plan to conduct any of the above (or similar) transactions in Italy, you should contact us immediately for a complimentary consultation. Kyckr is your global source for company intelligence, with access to over 0 official registries, 1 countries, 170 million legal entities.

Value Added Tax (VAT Rates) per Country Including VAT (Value Added Tax) rates for Spain, France, Belgium, South Korea, Japan, Pakistan, Singapore and more. If you are registered for VAT in Finland, the VAT number is formed using the country code FI and a string of digits that is the same as the Business ID without the dash between the two last digits For example, if the Business ID is , the Finnish VAT number is FI The structures vary from country to country. Liittyykö alvnumeroon tietty liikkeenharjoittajan nimi ja osoite EUmaiden kansallisiin viranomaisiin fr de en saa yhteyden eri tavoin Joissakin maissa, kuten Saksassa, Italiassa ja Espanjassa, on verkkopalveluja, kun taas toisissa kyselyt hoidetaan puhelimitse, sähköpostitse tai faksilla.

Vat Id All About The Vat Identification Number Instruction

The Mistery Of Envato Pty And Its Eu Vat Number Gd Consult

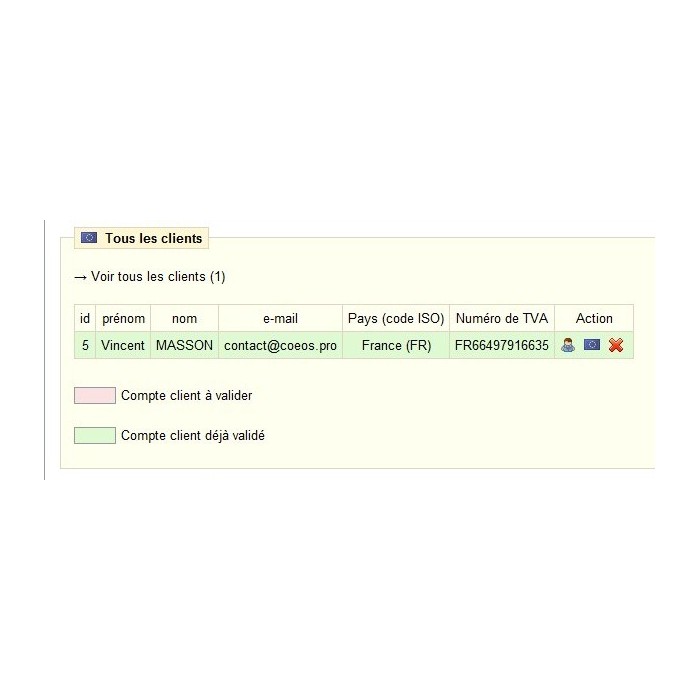

B2b Registration Siret Vat Number Automatic Group

Numero Vat のギャラリー

Vies Vat Number Validation Android Apps Appagg

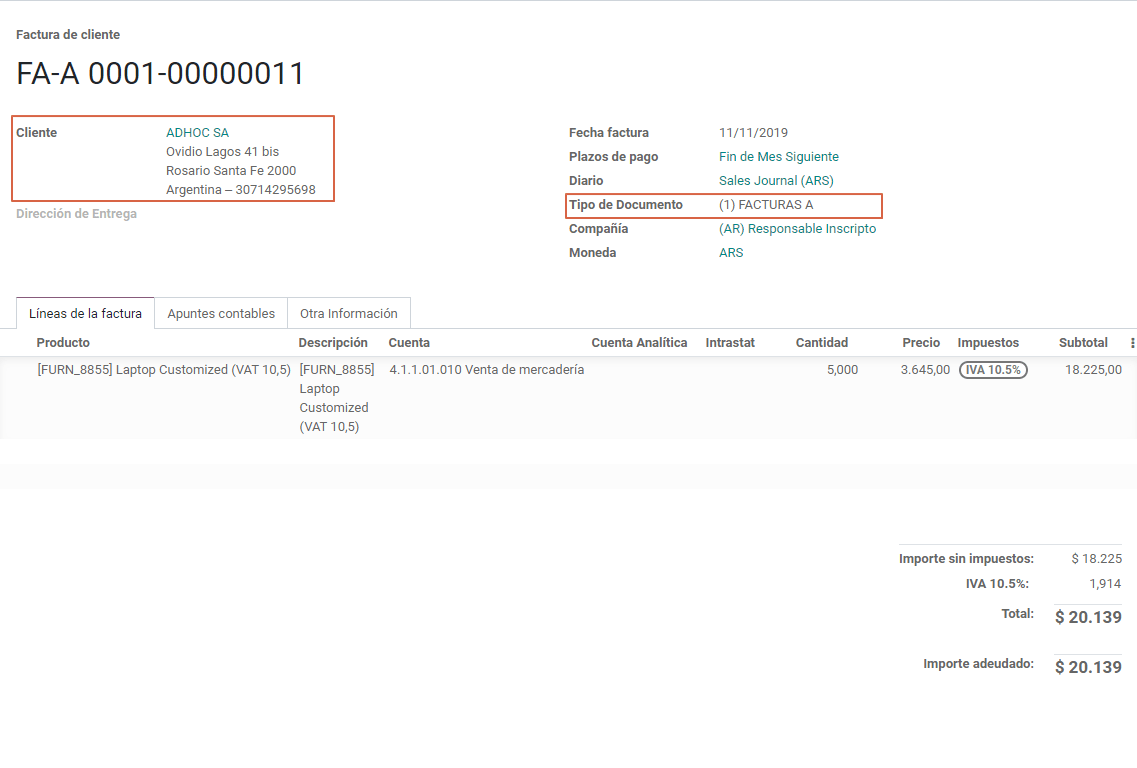

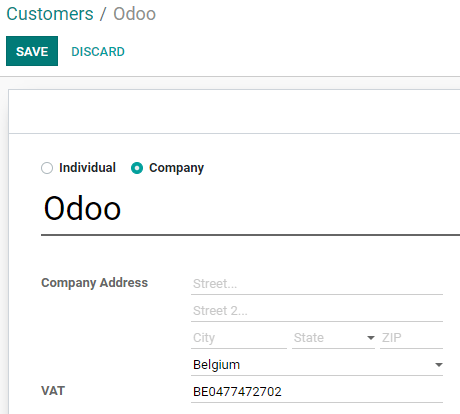

Argentina Odoo 14 0 Documentation

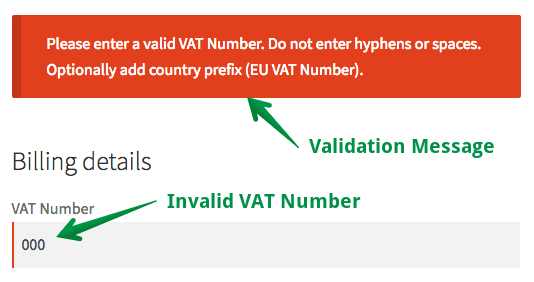

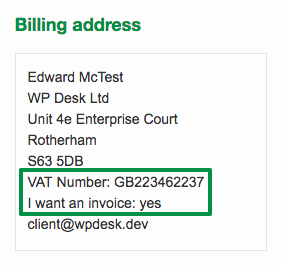

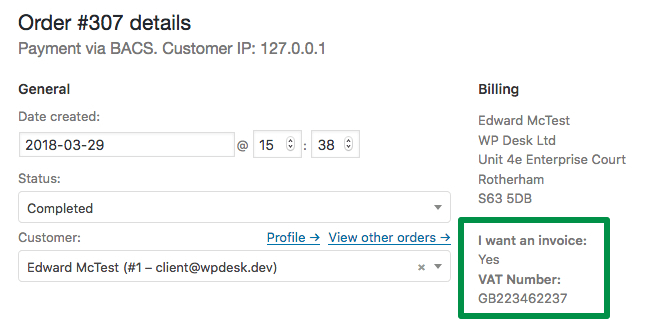

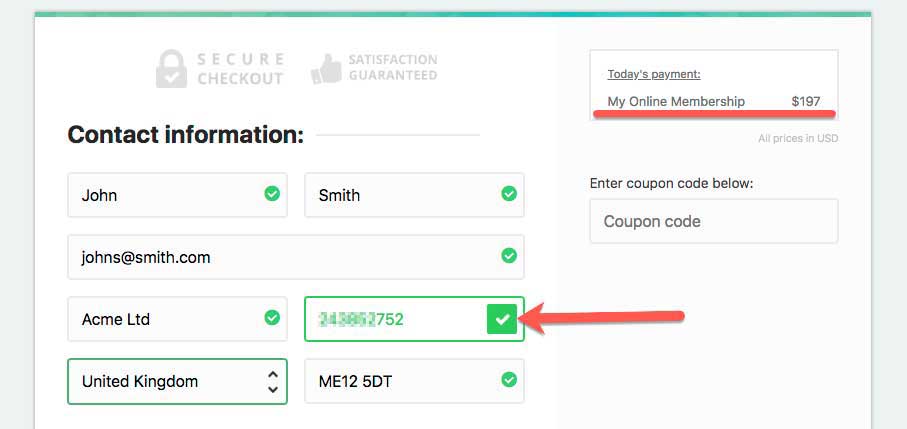

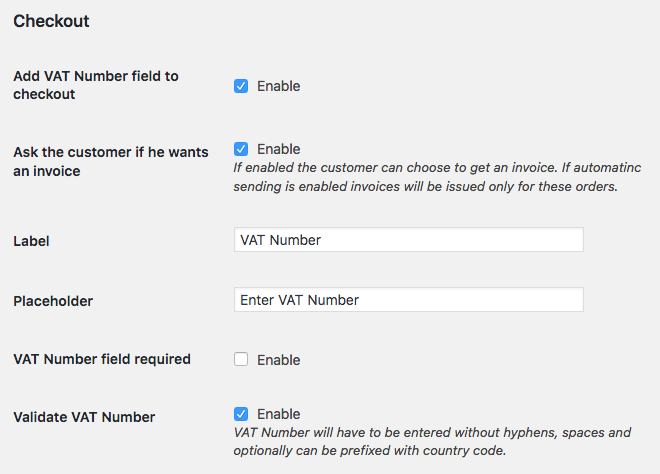

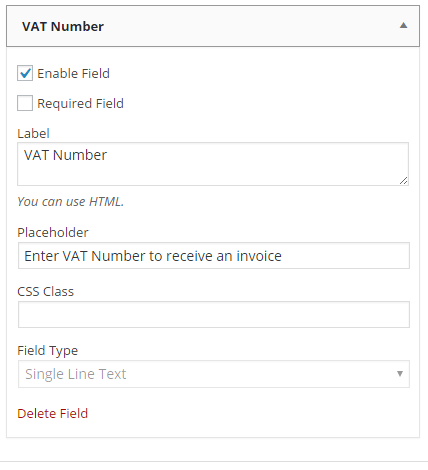

3 Easy Ways To Add A Vat Number Field In Woocommerce

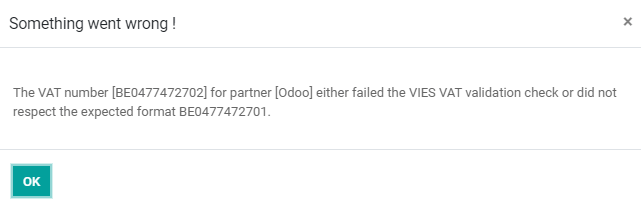

Validation Du Numero De Tva Intracommunautaire Par Vies Documentation Odoo 14 0

Audirvana Plus Licenses And Installation Audirvana

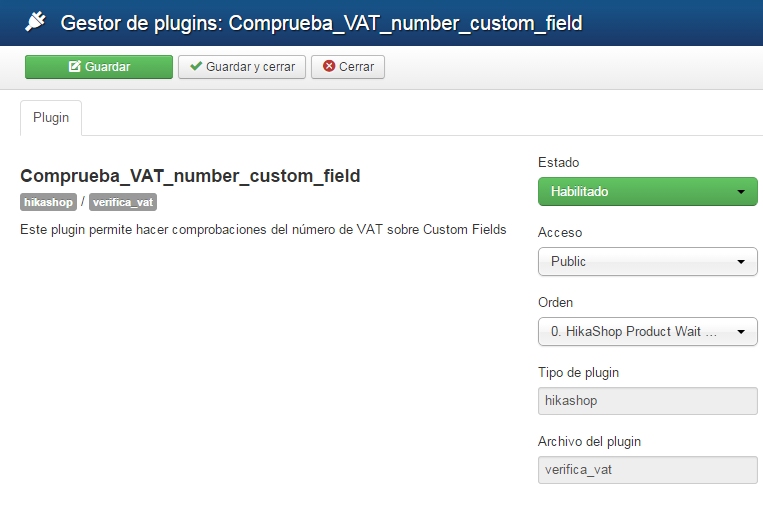

Gaminimas Afrika Popiete Prestashop Vat Module Yenanchen Com

Amazon Business Does Not Take Into Amazon Account The Change In Law As Of 01 01

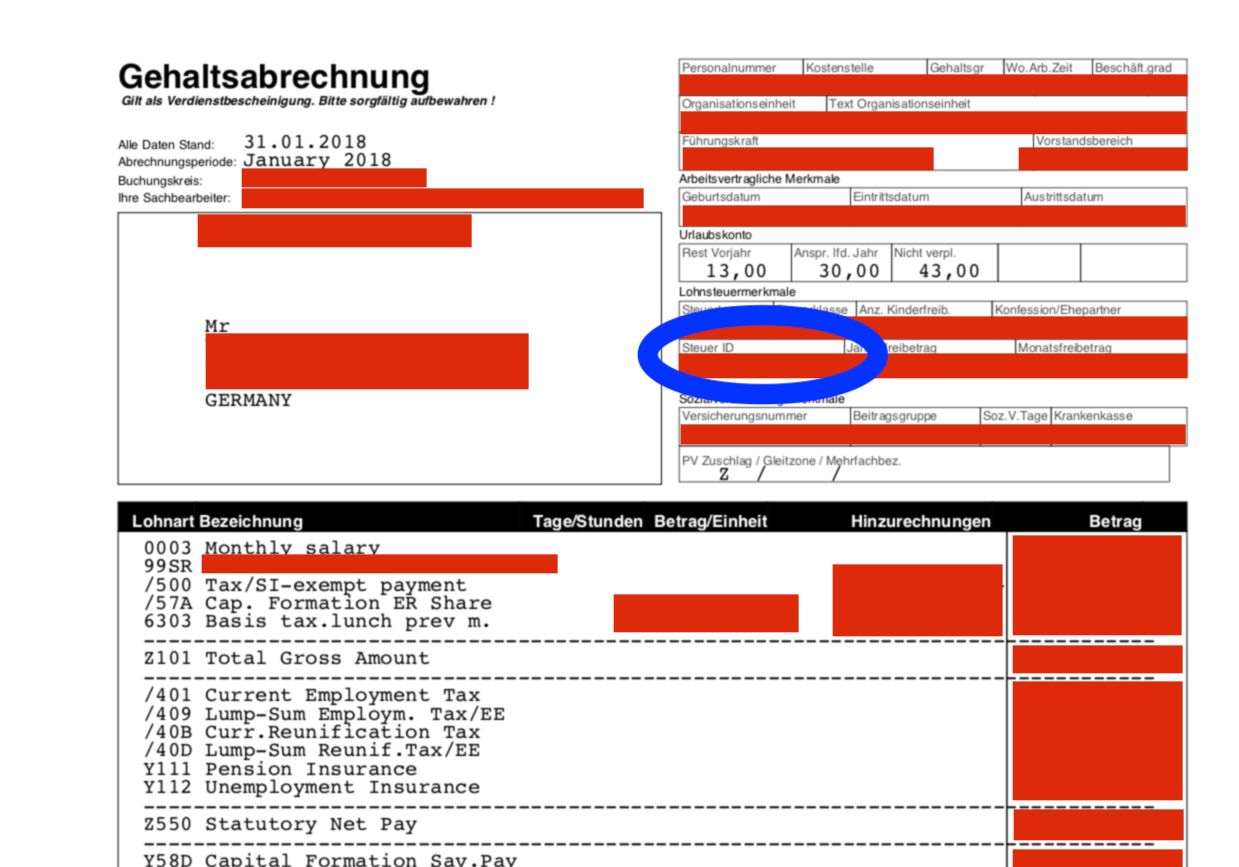

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

3 Easy Ways To Add A Vat Number Field In Woocommerce

Vat Number Blackbird Salesforce Consulting

Oecd Tax Database Oecd

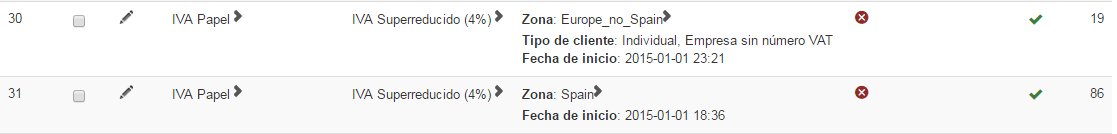

1 7 2 4 Id Number Vs Vat Number General Topics Prestashop Forums

Competition Adesignaward Com Document Download Php Id 143

3 Simple Ways To Find A Company S Vat Number Wikihow

Actualizar Identificacion Fiscal Usuarios Profesionales

How To Check The Validity Of An Intracommunity Vat Number

Zapptax Faq

What Is The Intra Community Vat Number Tas Consultoria

Italian Vat Identification Number Vgs Corporate Lawyers

Todo Lo Que Tienes Que Saber De Las Operaciones Intracomunitarias

Vat Value Added Tax Number In Spain Registration Process

Validation Du Numero De Tva Intracommunautaire Par Vies Documentation Odoo 14 0

Eu Vat And Client Group

Hikashop Taxes Apply Hikashop

Check The Intra Community Vat Number The Vies Tool

Include And Validate Your Customers Vat Registration Numbers Sufio For Shopify

Todo Lo Que Tienes Que Saber De Las Operaciones Intracomunitarias

Vat Nummer Was Ist Das Leicht Erklart

Nettoyeur De Numero De Tva Vat Cleaner Module Prestashop 1 6 Youtube

Applying For Vat Registration In France La Representation Fiscale

Vat Id All About The Vat Identification Number Instruction

European Vat For Ecommerce Businesses In Simple Terms Edesk

Que Es El Vat Number Ajc Asesor Fiscal

Robert Brandl A Little Warning If You Are From The Eu And Buying Stuff From Apple S Online Store Their Invoices Won T Let You Claim Vat Unless You Re From Ireland As

Amzito Invoicing Software For Amazon Europe Sellers 2 Automatically Generated Vat Invoices For Eu Amazon By Amzito Invoice Machine Pdf Format Facebook

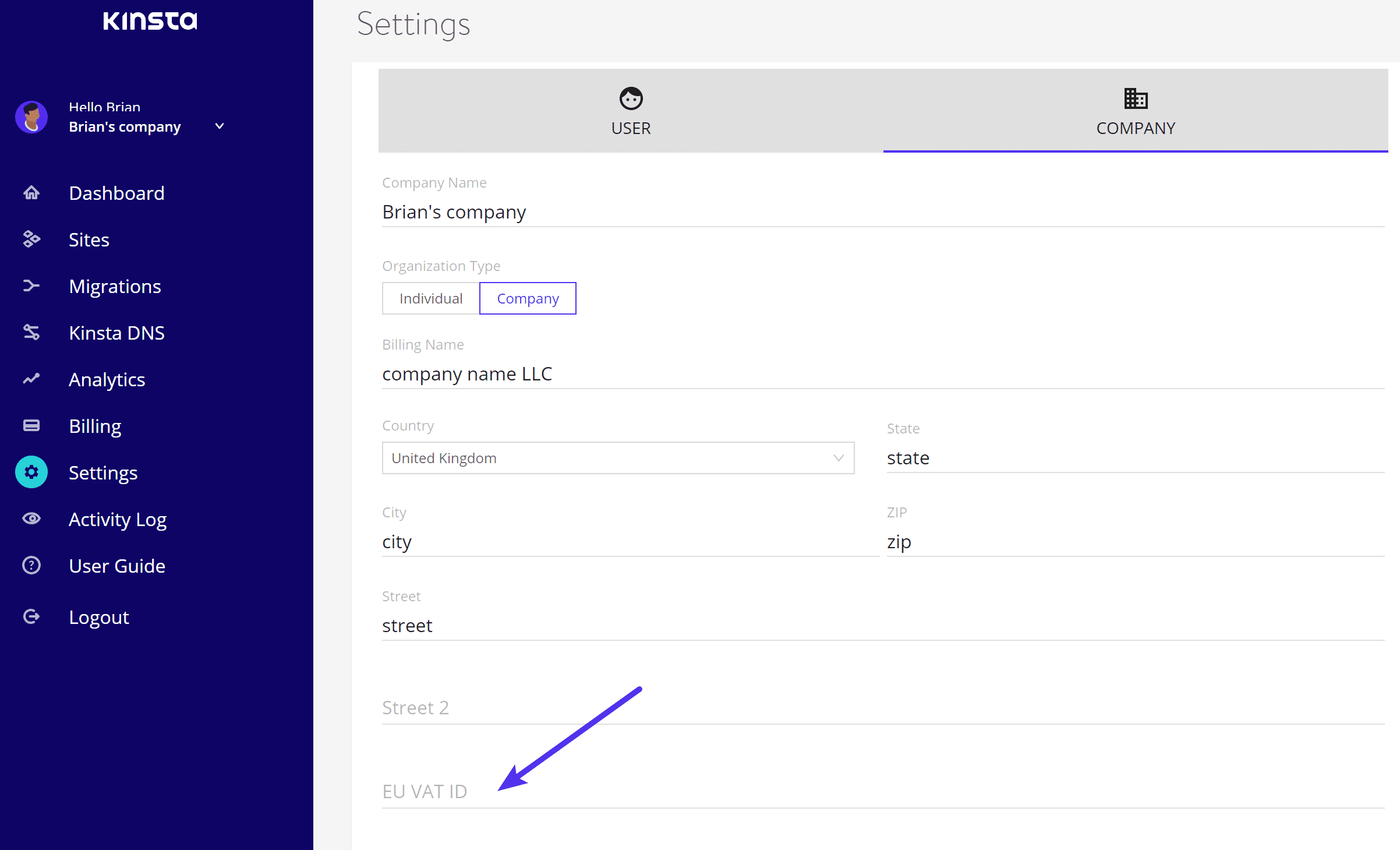

Como Adicionar O Numero Iva A Conta Kinsta Somente Para Empresas Da Uniao Europeia

Vat Compliance Control In Sap Meridian Global Services

Vat Id All About The Vat Identification Number Instruction

Http 192 167 108 132 Img Vat By Countries Pdf

Www Bzst De Shareddocs Downloads En Ust Idnr Aufbau Pdf Blob Publicationfile V 3

3 Easy Ways To Add A Vat Number Field In Woocommerce

Incorrect Vat Number On French Agency S Web Site Money Matters

Www Metrohm Com Media Files Metrohm Best C3 tigung estv 19 Pdf La

Q Tbn And9gcqhbwurlcwpelfeamhwewyq7o1wnia9oq5g2wpkl5x7rjmeyt Usqp Cau

Eu Vat Number Validation Thrivecart Helpdesk

How To Add A Vat Number To Your Kinsta Account

3 Simple Ways To Find A Company S Vat Number Wikihow

Pb With Vat On Invoices Wordpress Org

Tax Number Duplicate Checking In Mdg C S Sap Blogs

1 7 2 4 Id Number Vs Vat Number General Topics Prestashop Forums

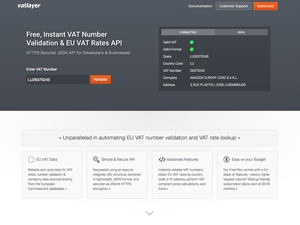

European Vat Number Validation Api

Ec Europa Eu

Eu Vat Number Validation Thrivecart Helpdesk

Eu Vat And Client Group

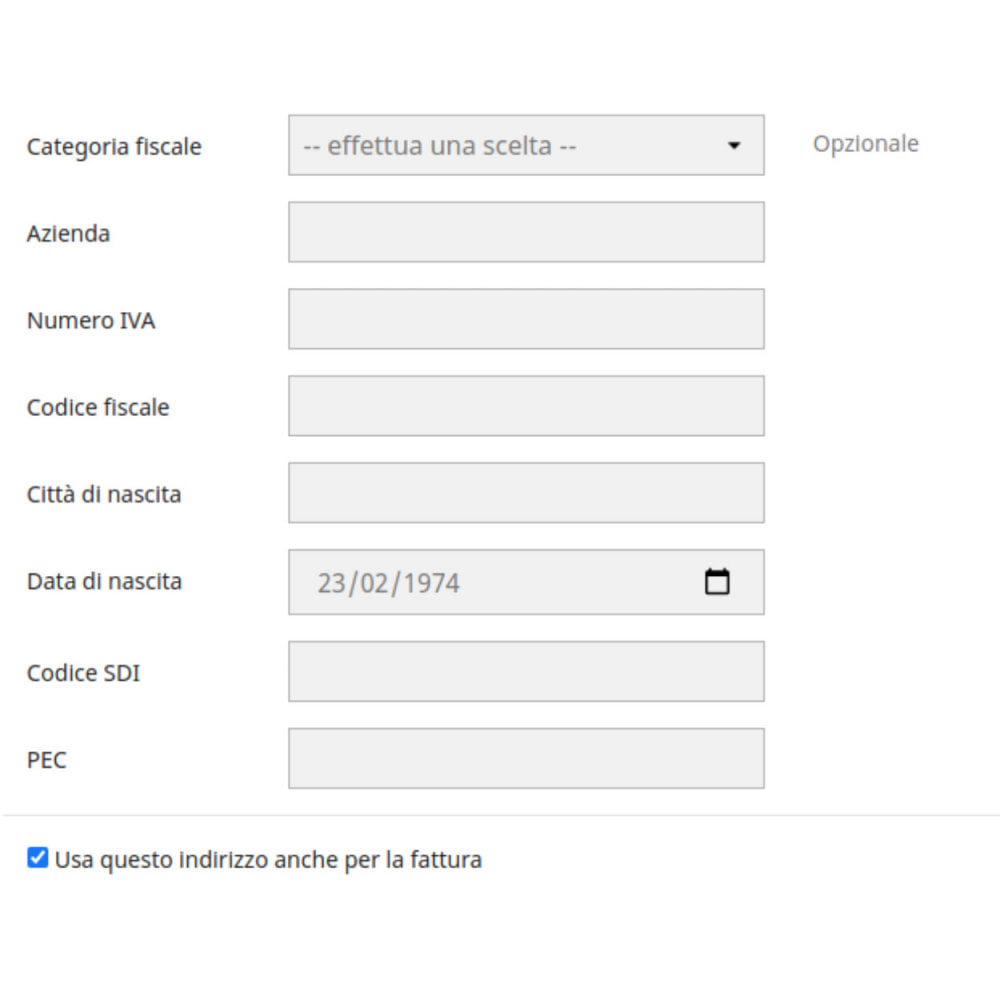

Vat Number And Personal Tax Code Pro

B2b Registration Siret Vat Number Automatic Group

Hikashop Invalid Vat Number For Individuals What Can I Do Hikashop

Vat For Freelancers Basics You Need To Know Kontist

3 Easy Ways To Add A Vat Number Field In Woocommerce

Eori Number What Is It How To Check It Hellotax

Todo Sobre El Numero Vat En Espana Para Que Sirve Y Como Pedirlo

Consulting Intra Community Operators Vies Tax Agency

Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Switzerland Tin Pdf

Consulting Intra Community Operators Vies Tax Agency

Vat Guide For Shopify Stores In The Eu Sufio For Shopify

Vat Sense Free Uk Eu Vat Number Validation Api Eu Vat Rates Api

Contracting Entity Is Google Ireland Adsense Help

How To Get A Eu Vat Number Vat Registration Quaderno

Vat Numarasi Nedir Nasil Geri Alinir Vat Numarasi Ornegi

Swiss Che Tax Registration Number Change Notice Oracle E Business Suite Support Blog

3 Easy Ways To Add A Vat Number Field In Woocommerce

Vat For Freelancers Basics You Need To Know Kontist

Mwst Pflichtig Ja Nein T V A Oui Non Iva Si No Vat Yes No Mwst Nr Numero T V A Numero Iva Vat No Pdf Kostenfreier Download

Mika On Vat Numero

1

3 Simple Ways To Find A Company S Vat Number Wikihow

Eori Number What Is It How To Check It Hellotax

Eu Vat Zoom Help Center

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

Vies Vat Checker For Android Apk Download

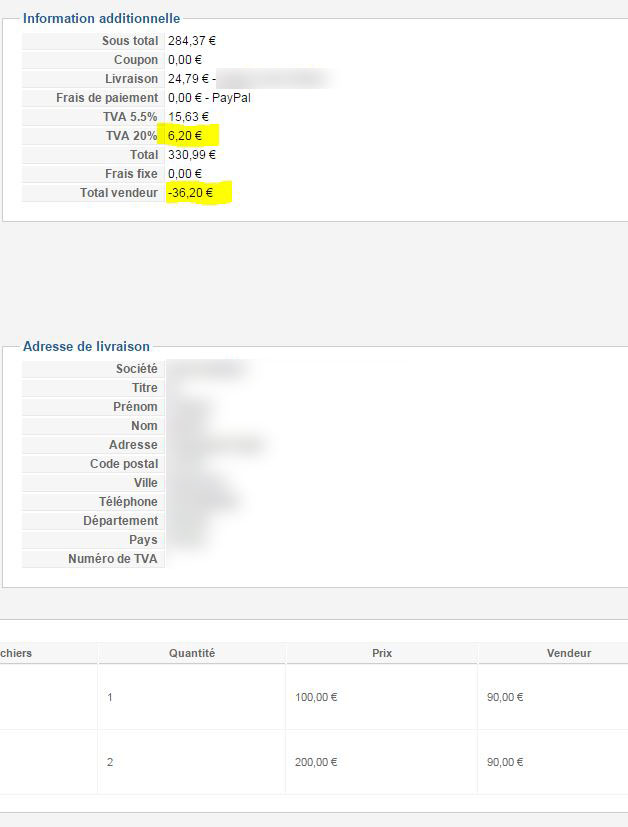

Hikashop Shipping Vat Added On Total Seller Hikashop

Zapptax Faq

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

Pin On Tilivahti Blogi

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

3 Easy Ways To Add A Vat Number Field In Woocommerce

Que Es El Vat Y Como Tramitarlo Circulantis

Vat Registration In Spain

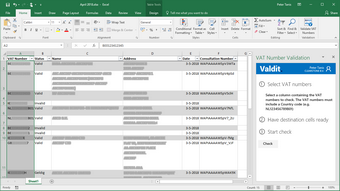

Check An European Vat Number Using The Vat Vies Service Valdit

Q Tbn And9gcttr4v0sstjjn9andzxfdvbswrbpylvp7cqyumoyo7xrztniz2x Usqp Cau

Que Es El Numero Vat Y Por Que Lo Necesito Blog Finutive

How To Get A Eu Vat Number Vat Registration Quaderno

Como Verificar Se O Numero De Iva Esta Em Conformidade Com Vies Pesquisar Autodesk Knowledge Network

Zapptax Faq

Q Tbn And9gcsz Oasbodlg9ieuccy 1t Fxfeig65e4tgpr9oh51nuitcsuz Usqp Cau

Ppf7kur0oamu8m

3 Simple Ways To Find A Company S Vat Number Wikihow

Vat Sense Free Uk Eu Vat Number Validation Api Eu Vat Rates Api

Eu Vat Number Validation Thrivecart Helpdesk

How To Get A Eu Vat Number Vat Registration Quaderno

Que Es Vat Number Importar De China Youtube