Numero Vat Chile

The numero which is at the bottom left of your ID is then your RUN Why do people mix up both then?.

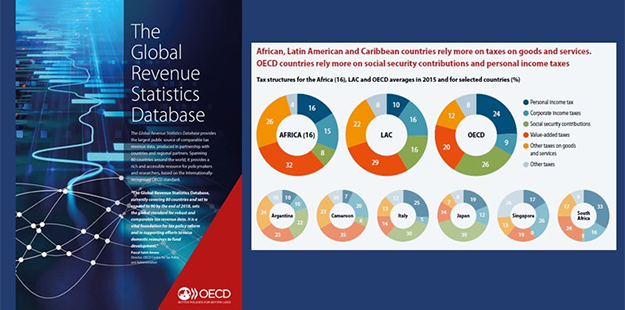

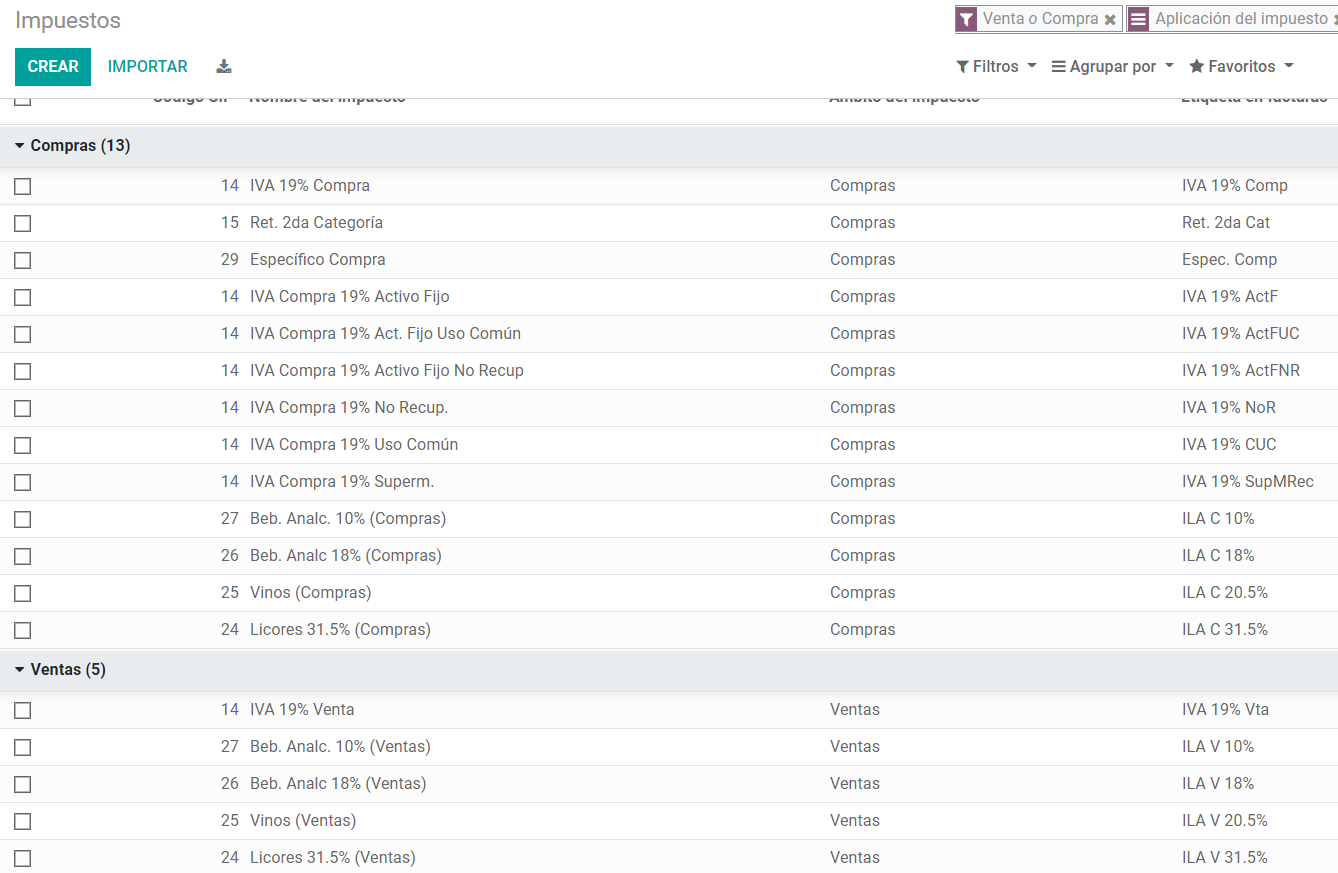

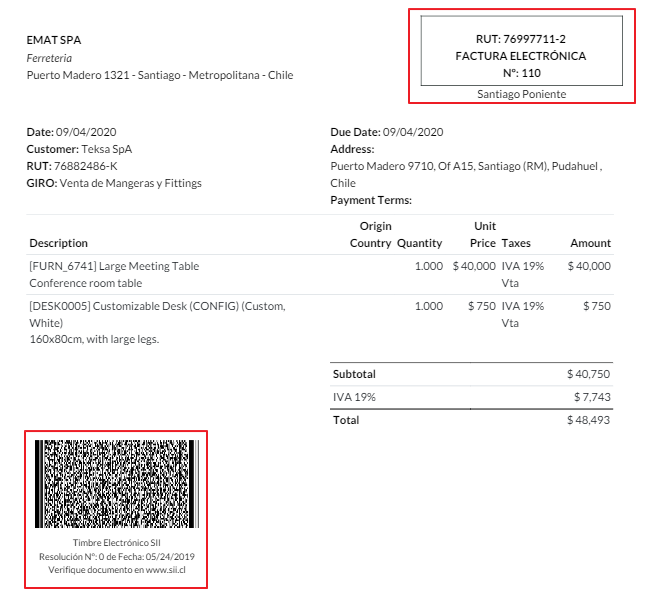

Numero vat chile. Resident in Chile under immigration law provisions, shall also request the TIN number to the SII (eg prior to investing in shares) In the case of Chileans and of foreigners resident in Chile, the National Identity Number (RUN) given by the Civil Registry also serves as Tax Identification Number (RUT). Chile has several tax types, the most common ones are VAT Is the regular VAT and it can have several rates ILA (Impuesto a la Ley de Alcholes) Taxes for alcoholic drinks It has a different rate Fiscal Positions Based on the purchase transactions, the VAT can have different affections. The VAT system in Chile is broadbased with few exemptions, mainly in health and education and with a 19% proportional rate It operates on the basis of taxation in the country where the respective goods or services are consumed or used In this context, VAT in Chile represents almost 50% of tax revenues.

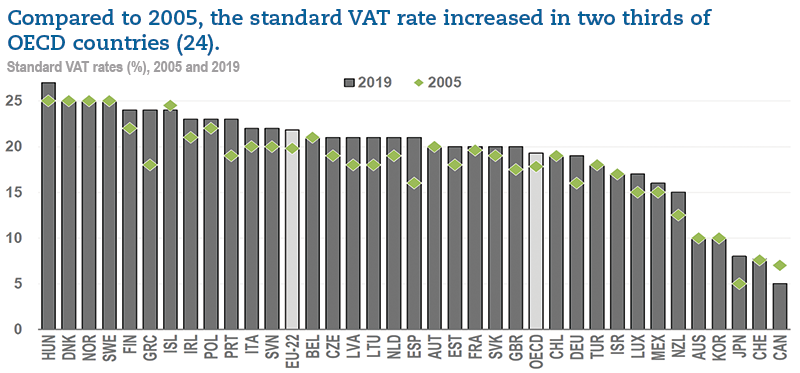

Usualmente, era agregado un número 2 al comienzo de las antiguas numeraciones, a medida que se ampliaba el número de dígitos para cada número de teléfono Zonas especiales (nivel nacional) Telefonía sobre IP 44 válido para los teléfonos por Internet de Chile Ej 56 44 XXXXXXX desde todo el país. On 1 June , the new 19% ValueAdded Tax (VAT) on digital services rendered by foreign digital service providers went into effect in Chile Foreign digital service providers that provide services to individuals in Chile must register for VAT purposes and report the relevant VAT Background. To defer VAT payment, companies must be part of the simplified taxation regime or the simplified general accounting regime In Chile, the VAT on goods and services is 19% Specifically, any sale equal or greater the $180 Chilean pesos must pay a 19% VAT (Called IVA, Impuesto al Valor.

Calculadora del IVA necesita dos valores Puede por ejemplo, rellene de IVA% y el precio con IVA y consigue el precio sin IVA como resultado Los valores son redondeados (dos dígitos). And Exempt exports of goods;. In Chile, VAT reaches 19% – indicating a surcharge of 19% on top of the normal price of the good and/or service.

You can lightningfast validate multiple VAT numbers at once, in real time, thanks to the cuttingedge technology VATappnet is built with Just copy&paste your VAT numbers into given form, where you can even choose different separators for your data Track realtime validation progress Save results in Excel/XLSX, CSV, TXT or PDF format, or just copy it to your system clipboard. Valueadded tax (VAT) VAT is payable on the transfer of goods and the provision of services at a 19% rate In general terms, this tax is levied over the price of the following goods and services Sales and other agreements used to transfer the ownership of tangible goods (movable and unmovable), provided that said operations are customary. En Chile el Servicio de Impuestos Internos (SII) es quien genera el número RUT (Rol Único Tributario), que, en el caso de las personas naturales, coincide con el RUN (Rol Único Nacional) En Colombia, el número de identificación tributaria para personas jurídicas se conoce como NIT.

The buyer will handle tax, via Chile's reversecharge mechanism. Ecuador has a national Valueadded tax (VAT) of 12% as of 21, administered by the Ecuadorian Internal Revenue Service (IRS) Visit this page for an executive summary of Ecuador's tax structure and rates, by SalesTaxHandbook. If you are registered for VAT in Finland, the VAT number is formed using the country code FI and a string of digits that is the same as the Business ID without the dash between the two last digits For example, if the Business ID is , the Finnish VAT number is FI The structures vary from country to country.

Número 600 de Latam en Chile A través de la comunicación telefónica, un gran volumen de usuarios encuentra la vía precisa para comunicarse de manera rápida y simple En este apartado le indicaremos el número 600 de Latam , para que usted pueda obtener información, realizar consultas o reclamaciones. La Ley N° , del 24 de febrero de , estableció que los servicios remotos remunerados prestados por no residentes no domiciliados en Chile, deben pagar el Impuesto al Valor Agregado (IVA) a partir del 1 de junio de. Dicho número, VAT o NOI, es el NIF del empresario, pero añadiéndole las siglas denominativas del país al que pertenece, es decir, en el caso de España, ES previamente al NIF En consecuencia, si tú NIF es B tu VAT o NOI será ESB Tramitar y conseguir VAT.

Under Chilean VAT rules, Zoom is required to collect and remit Chilean VAT on services provided to customers who do not carry out activities that are subject to VAT in Chile Customers who carry out activities that are subject to VAT in Chile may need to selfassess VAT on the services purchased from Zoom. Chile VAT information VAT International Global VAT, GST and Sales Tax news and information News;. La Comisión Europea emplea las dos expresiones VAT number y VAT identification number, en español, número de IVA y número de identificación de IVA Sin embargo, la Agencia Tributaria se refiere a él como el número de identificación fiscal (NIF) a efectos del IVA intracomunitario y opta por utilizar las siglas compuestas (NIFIVA) En las transacciones económicas entre empresas o.

VAT rates in Chile The current VAT rates are as follows text_vatrate_highest standard VAT rate;. Chile VAT information VAT International Global VAT, GST and Sales Tax news and information News;. Value added tax (VAT) is imposed on any transaction executed in Israel, on import of goods and on provision of services, in a single rate from the sum of the transaction or the price of the goods, as prescribed in a decree issued by the Minister of Finance.

Anyone spending a considerable amount of time in Chile is going to encounter a couple of important acronyms RUT and RUN If you have plans to live or travel long term in Chile, whether as a visitor or an expat, you’ll probably need to acquire a RUT or RUN of your own. VAT Calculator needs two values You can eg fill in VAT % and price and get preVAT price as result PreVAT price and price are rounded (two digits). VAT International / Chile Chile Chile VAT information (For news Chile VAT news) Summary Name of the tax Valueadded tax (VAT) Local name Impuesto al Valor Agregado (IVA) Date introduced 31Dec74 Trading.

Chile implemented a Value Added Tax regime in 1973 It is termed Impuesto al Valor Agregado (IVA) locally and is subject to the oversight of the Servicio de Impuestos Internos (SII) Should you register for Chilean VAT. Resident in Chile under immigration law provisions, shall also request the TIN number to the SII (eg prior to investing in shares) In the case of Chileans and of foreigners resident in Chile, the National Identity Number (RUN) given by the Civil Registry also serves as Tax Identification Number (RUT). Value added tax (VAT) is imposed on any transaction executed in Israel, on import of goods and on provision of services, in a single rate from the sum of the transaction or the price of the goods, as prescribed in a decree issued by the Minister of Finance.

VAT Calculator Chile Chile's VAT is also known as IVA (Impuesto al Valor Agregado) IVA rate is 19 % as on 15 and it is expected to increase in the upcoming years A benefit is provided to the foreigners and tourists They need not pay IVA if they stay in hotels for less than 60 days and if the hotel is registered with tax office of Chile. What do we understand by Value Added Tax (VAT) in Chile?. Any sale of a good or service that is executed in Chile is, in general, subject to VAT Likewise, it is the case of imports A final example of subject transactions could be the transfer of tangible resources for the lease of brands, patents, knowledge or other intangible VAT exemptions Exports of goods and services have absolute VAT exemptions.

Engineering or technical services, provided in Chile or abroad 15% If the payee is resident of a jurisdiction with a preferential tax regime, this rate is increased to % The payee is only required to submit a tax return regarding the payment of fees for the provision of general services in Chile Other income. Value added tax (VAT) is imposed on any transaction executed in Israel, on import of goods and on provision of services, in a single rate from the sum of the transaction or the price of the goods, as prescribed in a decree issued by the Minister of Finance. El Número de Identificación Fiscal (NIF) es la manera de identificación tributaria utilizada en España para las personas físicas (con documento nacional de identidad o número de identificación de extranjero asignados por el Ministerio del Interior) y las personas jurídicas 1 cita requerida El antecedente del NIF es el CIF, utilizado en personas jurídicas.

Collecting VAT in Chile Once you’re registered for taxes, you’re expected to charge 19% VAT on every sale to a Chilean resident If your customer is a fellow business, and they’ve provided a valid VAT number, then adding and collecting tax isn’t necessary!. Chile has a national Valueadded tax (VAT) of 19% as of 21, administered by the Internal Revenue Service (Servicio de Impuestos Internos, or SII Visit this page for an executive summary of Chile's tax structure and rates, by SalesTaxHandbook. Value added tax (VAT) is imposed on any transaction executed in Israel, on import of goods and on provision of services, in a single rate from the sum of the transaction or the price of the goods, as prescribed in a decree issued by the Minister of Finance.

The 19 percent ValueAdded Tax (VAT) for Chile is the standard, general, or most common tax in Chile Certain products or services in Chile may have a higher or lower tax You can change the default tax rate (VAT Percentage) in our calculator above if necessary. VAT Calculator needs two values You can eg fill in VAT % and price and get preVAT price as result PreVAT price and price are rounded (two digits). VAT is a consumption tax incorporated into the value of goods and services whenever value is added at any stage of the supply chain How much is VAT in Chile?.

Um número nacional de identificação, número de identidade nacional, ou o número nacional de seguro é utilizado pelos governos de muitos países como um meio de controle de seus cidadãos, residentes permanentes e residentes temporários para fins de trabalho, a tributação, os benefícios do governo, cuidados de saúde, e outros funções relacionadas acréscidas. El Número de Identificación Tributaria (NIT), es un número único que es asignado por la UAE Dirección de Impuestos y Aduanas Nacionales (DIAN) El NIT permite la individualización inequívoca de cada uno de los inscritos, es decir que facilita la identificación de cada contribuyente para todos los efectos,. A value added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value added tax purposes In the EU, a VAT identification number can be verified online at the EU's official VIES website It confirms that the number is currently allocated and can provide the name or other identifying.

Sales Tax Rate in Chile is expected to reach 1900 percent by the end of , according to Trading Economics global macro models and analysts expectations In the longterm, the Chile Sales Tax Rate VAT is projected to trend around 1900 percent in 21, according to our econometric models. Used cars and lorries;. Número VAT qué es y cómo se tramita Holded junio 25, junio 26, 18 En el presente texto trataremos de explicar qué es el VAT y cómo puedes tramitarlo Pese a que este número se suele confundir con el NIF, aquí te explicaremos las diferencias claras que existen entre uno y otro.

O VAT é um imposto incidente sobre o faturamento, nãocumulativo, ou seja, o imposto repassado nas aquisições pode ser deduzido do incidente nas vendas, e também é discriminado na nota fiscal, possibilitando ao consumidor saber exatamente a quantidade de tributo que está embutido no preço do bem ou serviço adquirido. You can lightningfast validate multiple VAT numbers at once, in real time, thanks to the cuttingedge technology VATappnet is built with Just copy&paste your VAT numbers into given form, where you can even choose different separators for your data Track realtime validation progress Save results in Excel/XLSX, CSV, TXT or PDF format, or just copy it to your system clipboard. Sí, sin VAT number o NIF intracomunitario podrás realizar cualquier operación intracomunitaria La desventaja.

Anyone spending a considerable amount of time in Chile is going to encounter a couple of important acronyms RUT and RUN If you have plans to live or travel long term in Chile, whether as a visitor or an expat, you’ll probably need to acquire a RUT or RUN of your own. Detalles sobre el número de teléfono El número de teléfono proviene de Chile (de acuerdo con el código internacional 56) 1 denuncias de usuarios suponen que ese número de teléfono es del siguiente tipo Suplantación de identidad. Muy a menudo, el número de IVA será el único número de identificación fiscal en el país correspondiente Sin embargo, a veces, las autoridades fiscales pueden emitir dos números un número de impuesto local para las transacciones locales y comunicaciones con las autoridades fiscales;.

The Chilean valueadded tax (VAT), also known as impuesto a las ventas y servicios (IVA), is a tax applied on the valueadded by suppliers in the supply chain VAT is applied on the recurrent sale or transfer of movable corporeal property located in Chile. Separately, if you are not VAT registered, Google will be applying a 19% Value Added Tax (VAT) on the service fee charged due to the expansion of the tax legislation in Chile The 19% VAT charge will be reflected separately from the service fee Your tax registration status determines the taxes that you are charged in Chile. Y un número de IVA extranjero o intracomunitario a.

The Chilean valueadded tax (VAT), also known as impuesto a las ventas y servicios (IVA), is a tax applied on the valueadded by suppliers in the supply chain VAT is applied on the recurrent sale or transfer of movable corporeal property located in Chile. VATSearch has more than 600 clients including By using VATSearcheu you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries Read More Hide Contact Imprint GTC About VATSearcheu Language. It’s quite easy to understand It is simply because for an individual person, Chilean or foreigner living in Chile, RUT and RUN are identical.

Solicitar el número de VAT en España te será fácil, pero es muy probable que debas aportar facturas emitidas o recibidas que justifiquen la necesidad de este número ¿Sin VAT number puedo realizar operaciones intracomunitarias?. The VAT law sets forth a new simplified regime for VAT compliance, available for nondomiciled or nonresidents that carry out operations falling under the new taxable events, either provided or utilised in Chile by individual nonVAT taxpayers. All traders seeking to validate UK (GB) VAT numbers may address their request to the UK Tax Administration Puede verificar la validez de un número de IVA en un país / Irlanda del Norte dado seleccionando en el menú desplegable el Estado Miembro / Irlanda del Norte e indicando luego el número de IVA que quiere comprobar.

Chile RUT(Rol Único Tributario) Costa Rica NITE (Número de Identificación Tributaria Especial) República Dominicana RNC (Registro Nacional del Contribuyente) Uruguay RUT (Registro Único Tributario) VAT (Value Added Tax) o NIF Código de Identificación Fiscal para empresas España. Anyone spending a considerable amount of time in Chile is going to encounter a couple of important acronyms RUT and RUN If you have plans to live or travel long term in Chile, whether as a visitor or an expat, you’ll probably need to acquire a RUT or RUN of your own. Entrance sporting and cultural events;.

VATSearch has more than 600 clients including By using VATSearcheu you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries Read More Hide Contact Imprint GTC About VATSearcheu Language. And education single_vatrate Chilean VAT. O VAT é um imposto incidente sobre o faturamento, nãocumulativo, ou seja, o imposto repassado nas aquisições pode ser deduzido do incidente nas vendas, e também é discriminado na nota fiscal, possibilitando ao consumidor saber exatamente a quantidade de tributo que está embutido no preço do bem ou serviço adquirido.

Separately, if you are not VAT registered, Google will be applying a 19% Value Added Tax (VAT) on the service fee charged due to the expansion of the tax legislation in Chile The 19% VAT charge will be reflected separately from the service fee Your tax registration status determines the taxes that you are charged in Chile. VAT International / Chile Chile Chile VAT information (For news Chile VAT news) Summary Name of the tax Valueadded tax (VAT) Local name Impuesto al Valor Agregado (IVA) Date introduced 31Dec74 Trading.

Canada To Tax Digital Services Provided By Foreign Companies

Que Es El Vat Iva Intracomunitario Y Vies Billin

Chile Wts Global

Numero Vat Chile のギャラリー

Www Pwc Com Gx En Tax Pdf A Guide To Vat Gst Sut In The Americas Pdf

Chile Wts Global

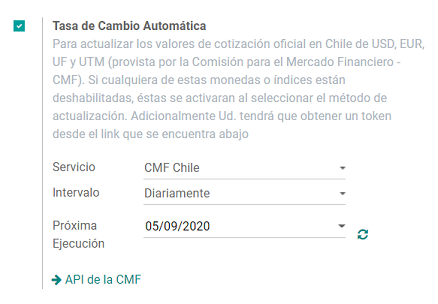

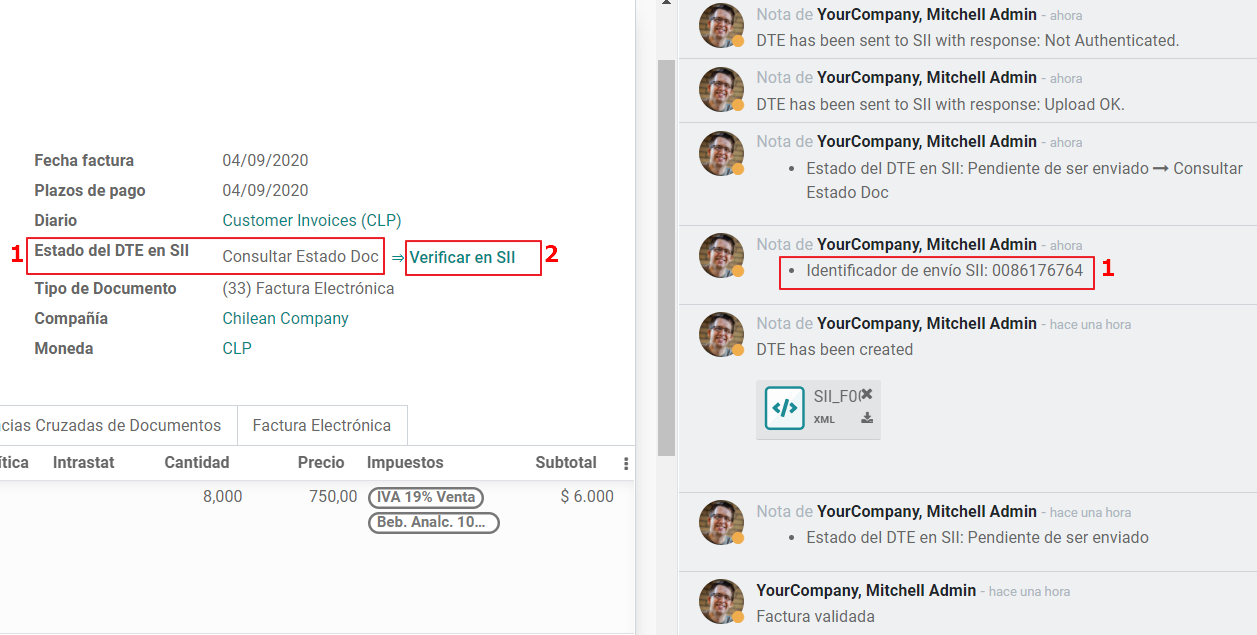

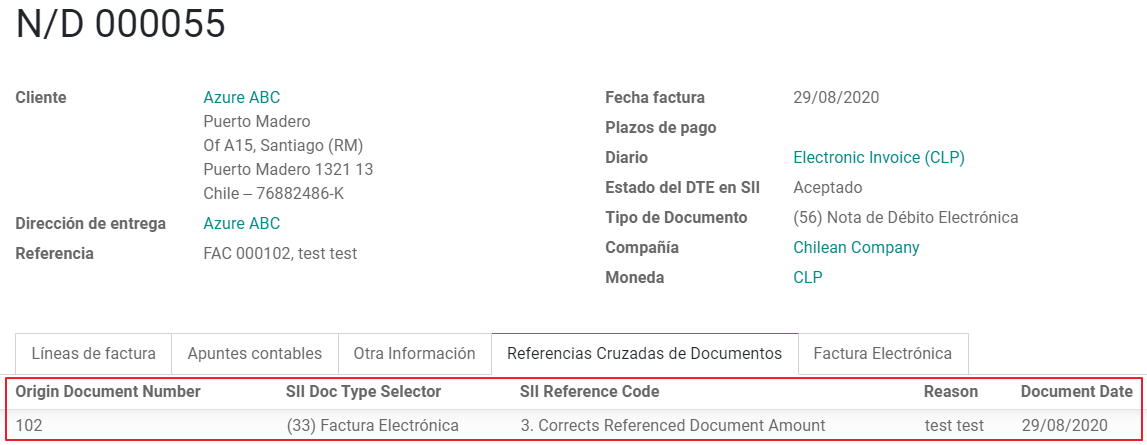

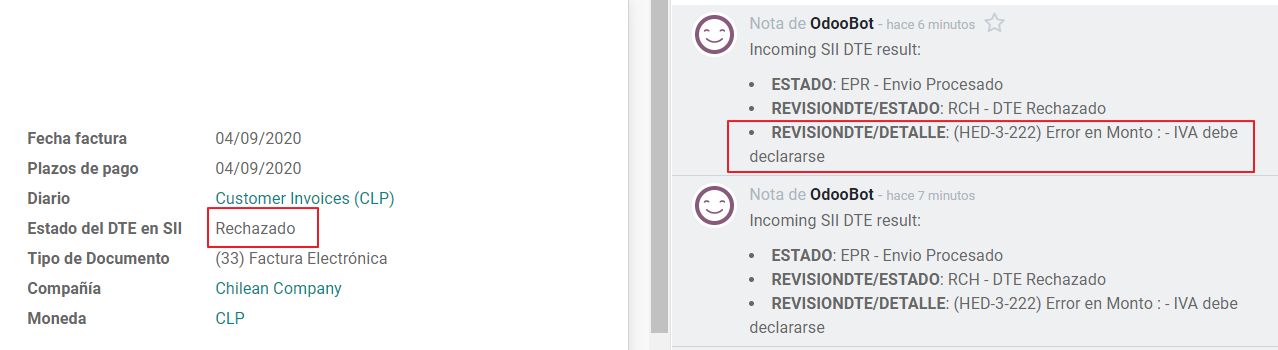

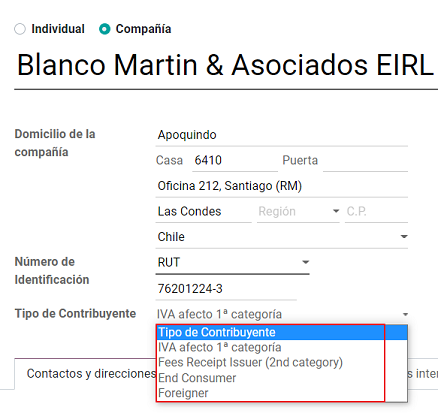

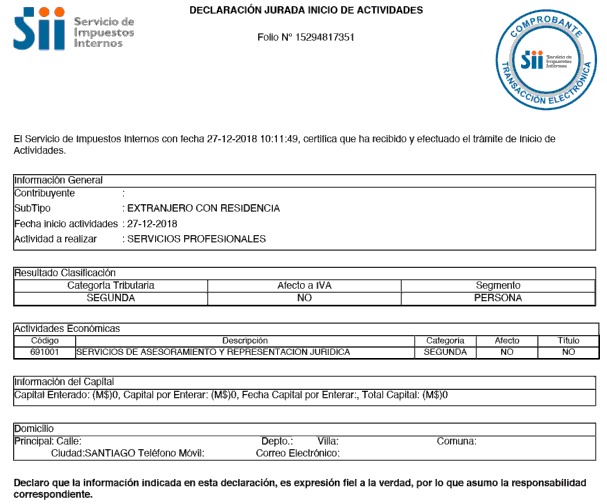

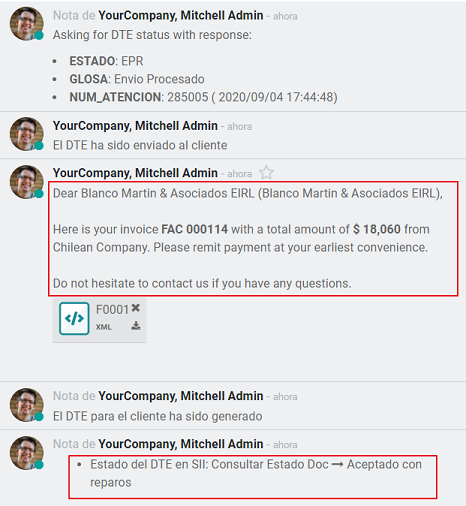

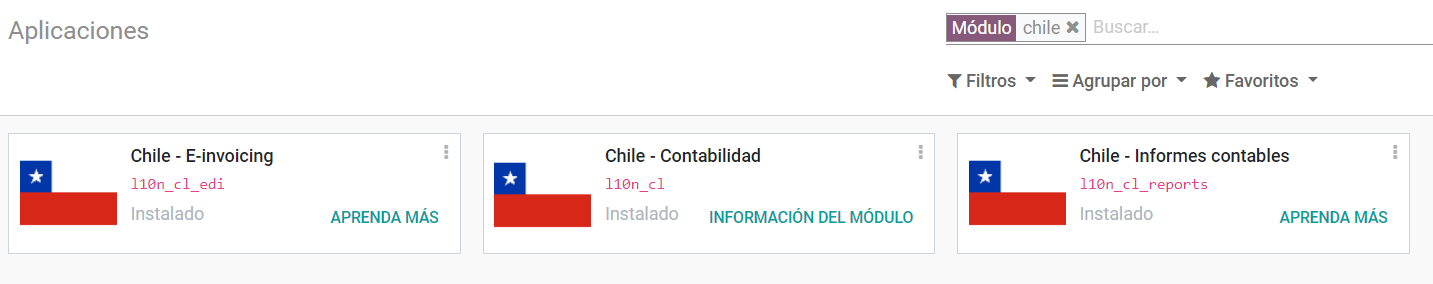

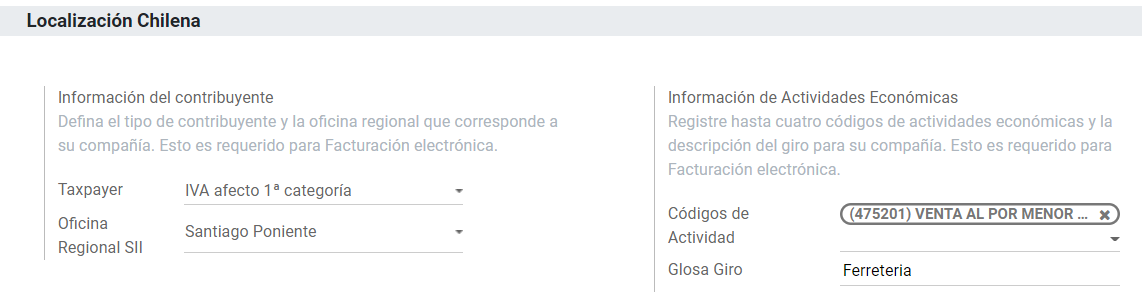

Chile Odoo 14 0 Documentation

Vat In Luxembourg Luxembourg Vat Rates Number Registration

Chile Odoo 14 0 Documentation

A Complete Guide To Rut And Run In Chile Transferwise

Vat For Freelancers Basics You Need To Know Kontist

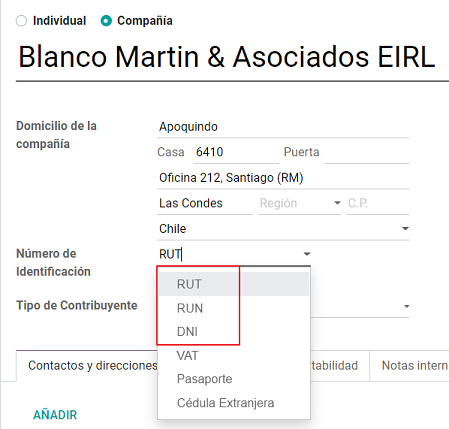

Actualizar Identificacion Fiscal Usuarios Profesionales

Www Eulerhermes De Content Dam Onemarketing Ehndbx Eulerhermes De Dokumente Improve Company Search On Eolis Pdf

Correo De Spotify Premium Chile

Chile Vat Guide For Businesses

How To Check The Validity Of An Intracommunity Vat Number

Oecd Tax Database Oecd

Chile Odoo 14 0 Documentation

Que Es El Vat Y Como Tramitarlo Circulantis

Rut And Run Two Id Numbers To Know Expat Cl

Chile Vat On Foreign Supplied Digital Services

Oecd Tax Database Oecd

Chile Odoo 14 0 Documentation

Value Added Tax Identification Number

Tax Ids

10 Best Puerto Montt Hotels Chile From 34

Www Sii Cl Vat Circular 42 Esp Pdf

Pdf Impuestos Y Distribucion Del Ingreso En Chile Un Poco De Aritmetica Redistributiva Desagradable

Chile Indirect Tax Guide Kpmg Global

Chile Vat On Foreign Supplied Digital Services

Chile Odoo 14 0 Documentation

How Long Does One Have To Keep The Immigration Paper Given By Chilean Immigration Upon Entering Chile Travel Stack Exchange

Tax Ids

Company List

Apostille From Chile

Www Doingbusiness Org Content Dam Doingbusiness Country C Chile Chl Pdf

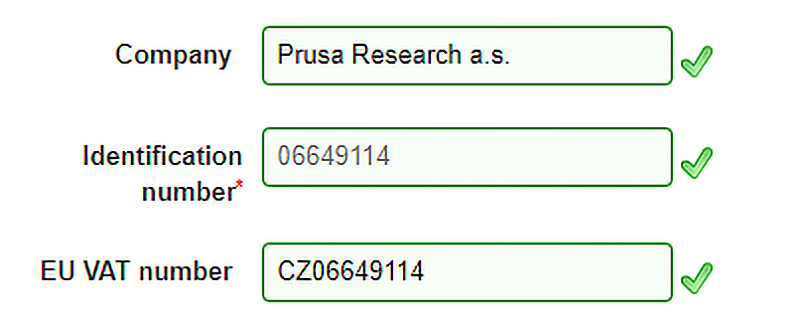

Prusa Knowledge Base Vat Value Added Tax Customs Fees

Vat Registration In Portugal

A Quick Guide To Value Added Tax Vat In Chile

Chile Odoo 14 0 Documentation

All For One Steeb Vat Number Validation Erp For Small And Midsize Enterprises

European Vat Number

Q Tbn And9gcrp4egnqt4xdnnbagqgnky0n7l0zhxtlscznoqfj Liagjxurk4 Usqp Cau

Chile Odoo 14 0 Documentation

Impuestos Sin Contribuyentes La Invisibilidad De Los Impuestos En Chile

European Vat Number

Bulgaria Cuts Vat Rate To 9 On Books And Restaurant Services

European Vat Number

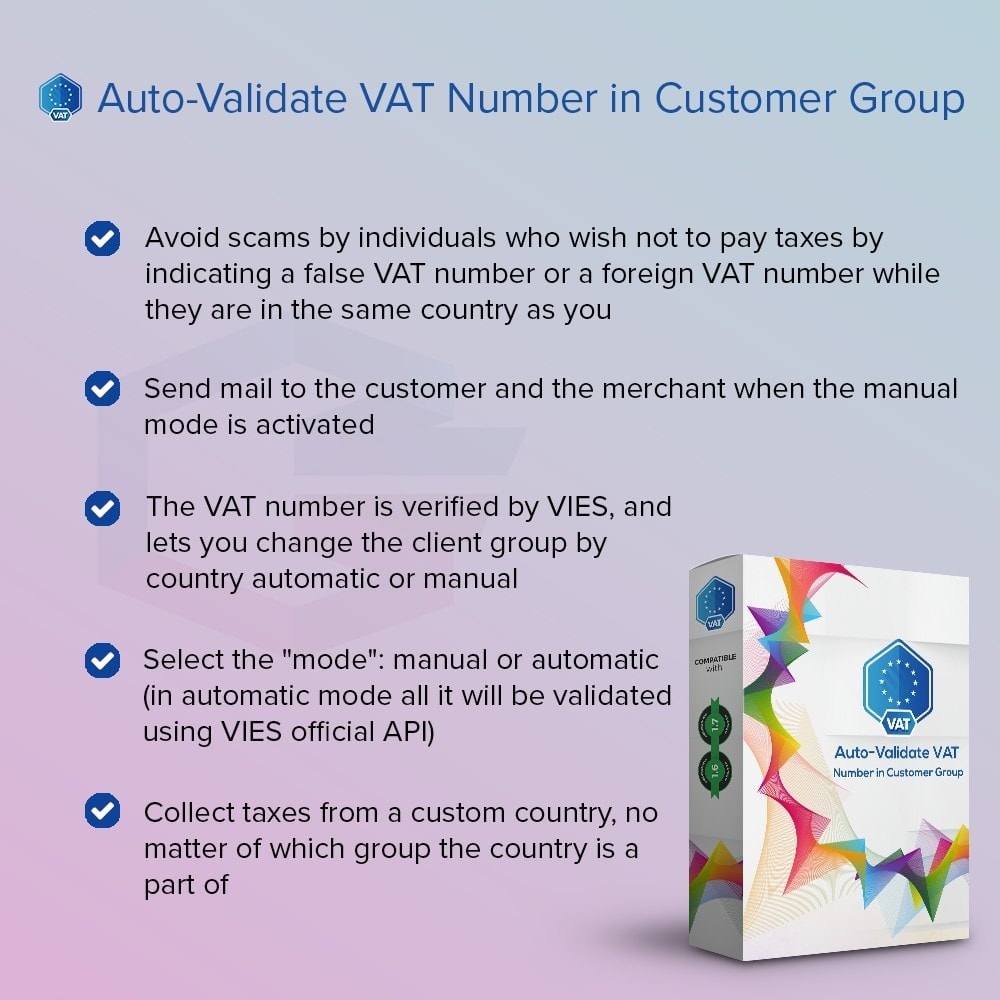

Auto Validate Vat Number In Customer Group Prestashop Addons

B2b Registration Siret Vat Number Automatic Group

All For One Steeb Vat Number Validation Erp For Small And Midsize Enterprises

Www Eulerhermes De Content Dam Onemarketing Ehndbx Eulerhermes De Dokumente Improve Company Search On Eolis Pdf

Pdf Impuesto Al Valor Agregado Iva A Los Alimentos De La Canasta Familiar En Colombia Proyecto De Ley 197 De 18

Chile Vat On Foreign Supplied Digital Services

Www Ciat Org Biblioteca Seminariosytalleres 12 Workshoponexchangeofinformation Eoi 16 17 Socoroo Velazquez Ciat The Use Of Tins Reply To Eoi Requests Pdf

Que Es El Iva Como Se Declara El Impuesto Al Valor Agregado Iva Rankia

Imprint

Chile Odoo 14 0 Documentation

Que Es El Vat Number Para Que Sirve Como Solicitarlo

Impuesto Al Valor Agregado Wikipedia La Enciclopedia Libre

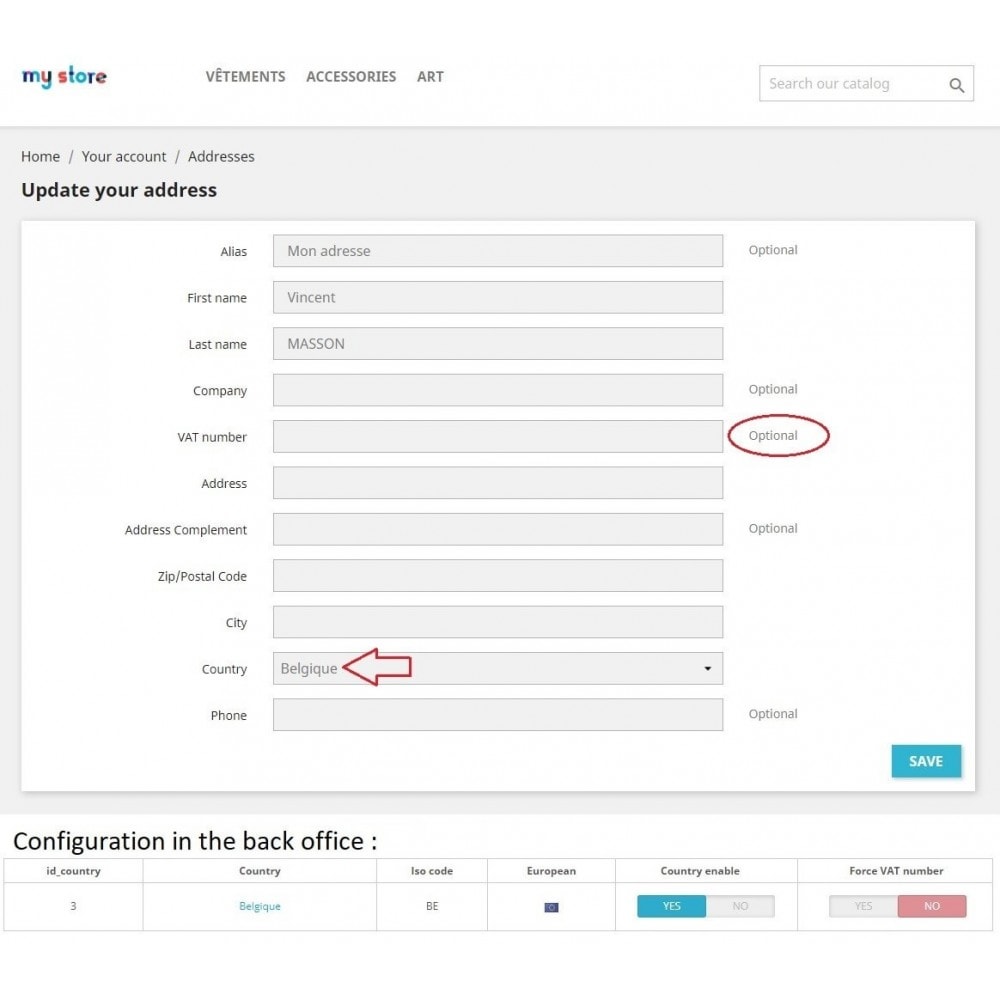

Force The Vat Number According To The Country

How To Apply For Permanent Residency In Chile Step By Step Lost In Chile

Prusa Knowledge Base Vat Value Added Tax Customs Fees

What Is Vat Rsm Kuwait

Q Tbn And9gctmfga1l2ncmlffii Uvexb7fidc2kolnazggxk 3fjovfl7apr Usqp Cau

Chile Wts Global

Voec Vat On E Commerce In Norway Ecovis Explains

Senegal Vat Changes 18 Wts Global

Industrial Policy In Argentina Brazil Chile And Mexico A Comparative Approach

Chile Odoo 14 0 Documentation

Impuestos Sin Contribuyentes La Invisibilidad De Los Impuestos En Chile

Back Matter Tax Law Design And Drafting Volume 2

Vre

Chile Vat Zoom Help Center

Devoluiva Vat Refund Invoice

Chilean Vat Guide Avalara

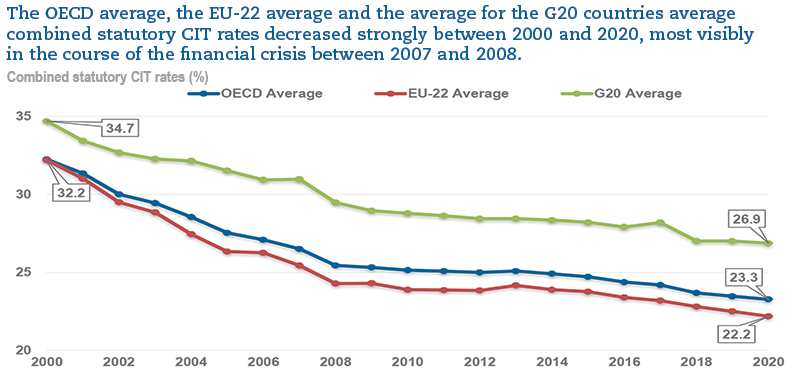

Oecd Tax Database Oecd

Q Tbn And9gcteavcykma0jayd5udkdm47qlc1t0 Jwmvvzoukfq4qu32ic27k Usqp Cau

Chile Odoo 14 0 Documentation

6 K 1 Tv 6k Htm Form 6 K United

Iva De Los Servicios Digital Servicio Impuestos Internos

Canada To Tax Digital Services Provided By Foreign Companies

Www n Cl Obtienearchivo Id Repositorio 146 5 Jpc iva diferenciado en oecd Pdf

Chile Odoo 14 0 Documentation

How To Get An Intra Community Vat Number Asd Group

Competition Adesignaward Com Document Download Php Id 143

European Vat Number

Www Pwc Com Gx En Tax Indirect Taxes Assets Guide To Vat Gst Sut In The Americas 18 Indirect Tax Guidance Of 21 Countries In The Americas Pdf

European Vat Number

Auto Validate Vat Number In Customer Group Prestashop Addons

Www Pwc Com Gx En Tax Pdf A Guide To Vat Gst Sut In The Americas Pdf

Valdivia Chiletouristik

Industrial Policy In Argentina Brazil Chile And Mexico A Comparative Approach

Chile Odoo 14 0 Documentation

How To Get An Intra Community Vat Number Asd Group

Vre

Tranet Certified Translation Of A Certificate Of Conduct From Spanish To English

Que Es Vat Number Importar De China Youtube

Oecd Tax Database Oecd

Chile Wts Global

Business Procedures In Rwanda

Www Jstor Org Stable

How Import Taxes Work Vat Duties And Customs Clearance Vatglobal

1

What Is Vat Rsm Kuwait